Banking on customer experience and security via technology-based innovation

CIO

JULY 20, 2023

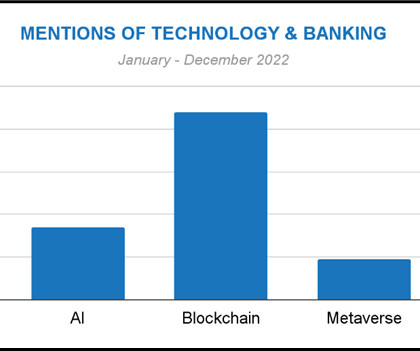

Quick loan approvals, online applications, personalized lending options, and massive data breaches create pressure for banks to focus on customer experience and security to compete with more technically mature and agile competition. Security and privacy. Source: “Innovation Digital Listening Research.”

Let's personalize your content