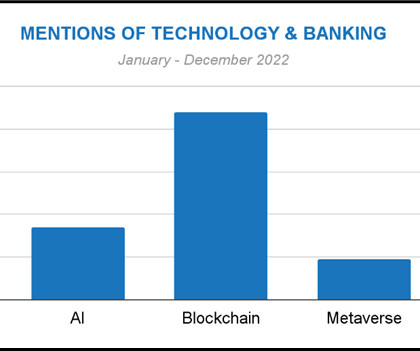

Banking on customer experience and security via technology-based innovation

CIO

JULY 20, 2023

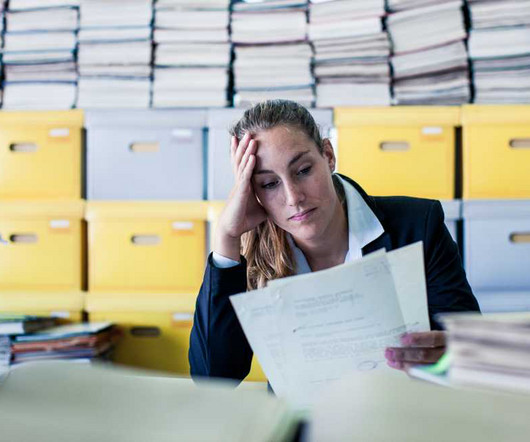

Customer experience and security But as in most industries, customer expectations and security challenges continue to grow along with technological advances. Banks continue investing in technologies that make the customer experience seamless, including mobile apps and peer-to-peer payments. Security and privacy.

Let's personalize your content