Peer-to-peer car-sharing company Turo filed to go public last night. TechCrunch’s first look at its S-1 filing is here, in case you missed it.

That Turo has filed to go public is not a surprise. After raising nearly $500 million while private, the company has an enormous capital base underneath it, meaning that there is also institutional pressure for the firm to pursue an IPO. Turo first raised external capital back in 2009, Crunchbase data indicates, so some investors have been waiting for the company’s S-1 filing for a long, long while.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

The good news is that Turo’s business had a turnaround year last year. After posting somewhat lackluster 2020 results, Turo saw its revenues and results rebound, at least through the third quarter. We’ll get Q4 data in a subsequent S-1 filing.

This morning, I want to compare and contrast the company’s 2020 and 2021 results as a way to show how some unicorns will come out of the pandemic with jets on. Frankly, the Turo income statement, once we beat back some non-cash costs muddying its bottom line, has me impressed.

Let’s talk about acceleration post-lockdown.

Turo’s financial rebound

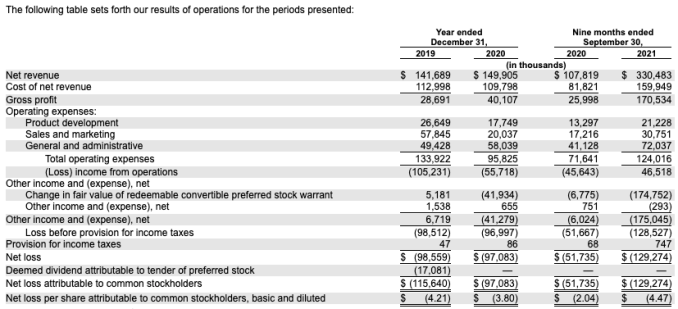

From 2019 to 2020, Turo recorded slim revenue growth. The company’s top line grew from $141.7 million to $149.9 million, or around 6%. For a venture-backed company ramping toward an IPO, that’s an incredibly thin pace of growth.

Even worse, the company’s net losses stayed essentially flat during the period, decreasing just a smidge from $98.6 million worth of negative net income in 2019 to $97.1 million in 2020.

But then, 2021 came around. Observe the differential in results:

As you can see when we contrast the first three quarters of 2020 with the same portion of 2021, the company’s revenue growth reignited, and it swung from stinging operating losses to operating profits. It appears that last year was a rebirth of sorts for Turo — it left slow growth behind for hyper-growth (207% between 2020 and 2021, for the periods listed) and losses for profits (on an operating basis).

Yes but, I can hear you saying, the company’s net loss actually got worse in the first three quarters of 2021 when compared with the preceding year. Why are we giving it plaudits for growth when it torched so much money?

The reason is that the company’s net losses are effectively accounting deficits — they aren’t connected to its operating results. More simply, changes to the “fair value of redeemable convertible preferred stock warrant” liabilities pushed $175.0 million worth of accounting costs into the company’s 2021 results, meaning that instead of posting a tidy, positive net income figure, the company instead “recorded” a huge loss.

What is this charge that we’re dealing with? Per the company’s filing:

The change in the fair value of redeemable convertible preferred stock warrant liability consists of the net changes in the fair value of our outstanding warrants to purchase redeemable convertible preferred stock that are remeasured at the end of each reporting period. We will continue to recognize changes in the fair value of warrants until each respective warrant is exercised, expires, or qualifies for equity classification.

My read of this is that the fair value of the company’s redeemable convertible preferred stock went up, meaning that warrants for the same also gained value. Which counts as a cost. So, the company’s operating income turned into net losses, despite Turo’s business results actually looking pretty spry.

Is this an argument for adjusted metrics? Not really; it’s more a note that you need to read income statements completely before you pass judgment on their bottom figures. Adjusted EBITDA fixes the Turo issue in the same way that beheading is a perfectly complete way to heal a headache. Still, for the sake of you non-GAAP fanatics out there, the company first reached positive adjusted EBITDA in Q3 2020, and sustained positive adjusted EBITDA in Q2 2021, after which it set successive all-time records for the profit-ish metric.

So, what changed at Turo that led to growth coming back, and the company’s operating profit turning from red to green?

More revenue, more revenue quality

Two things came together for Turo to post its rebound: a boom in revenue and a massive increase in revenue quality.

On the revenue side of the coin, here’s how Turo explains the sharp increase in its total top line (emphasis added):

Net revenue increased $222.7 million, or 207%, for the nine months ended September 30, 2021 compared to the nine months ended September 30, 2020. The increase was driven by a 163% increase in Days combined with a 40% increase in GBV per day. Days and GBV per day increased due to surging demand in travel as a result of increased accessibility of COVID-19 vaccines, lifting of travel restrictions, and increased consumer comfort with travel, the effects of which on our net revenue were compounded by a rental car supply shortage.

GBV stands for gross booking value, as you guessed, which we can use mentally as the company’s GMV. Parsing the above paragraph, the company saw more total cars hired and a higher per-car rate. The combination pushed it to new scale.

From a pandemic perspective, I think that 2020 was a year in which more folks tried to stay home and not move about. But 2021 was a bit different. I am not trying to align the company’s growth in your mind with a chart of COVID-19 infections, but I do think that as people moved around more, so did the virus. Regardless, for Turo, folks getting back into the world was a boon.

Not only did Turo massively boost its total revenue footprint — its revenues jumped in quality last year. Again from its S-1 filing (emphasis added):

As a percentage of net revenue, cost of net revenue was 48% for the nine months ended September 30, 2021, compared to 76% for the nine months ended September 30, 2020. Insurance and host protection program costs, as a percentage of net revenue, were 33% for the nine months ended September 30, 2021, compared to 54% for the nine months ended September 30, 2020. Liability insurance (both premiums and insurance reserves) and host protection program costs increased due to the increase in Days, offset by lower loss ratios and improved guest risk profiles.

That’s pretty self-explanatory and very bullish. Why? Because as Turo saw more total volume (GBV), its customer profile improved. Normally we’d expect the opposite — that the company’s customer profile would dilute as it grew, leading to slightly worse economics as it scaled.

This means that Turo’s comeback from its 2020 malaise was something akin to a holistic improvement to its corporate health. I am impressed.

Let’s not call the ball before we get Q4 2021 data, but at least from where I stand, Turo is evidence that more unicorns than merely Airbnb can come back from pandemic-induced lows to kick some pretty serious butt. More when we get fresh data.

Comment