What a busy week in the world of media liquidity.

That’s a sentence you don’t get to write often. Regardless, news broke this week that Axel Springer is buying U.S. political journalism outfit POLITICO. The transaction was expected, but the eye-popping roughly $1 billion price tag still has tongues wagging. We even got on the podcast to chat about it.

And Forbes announced that it is going public via a SPAC. The business publication’s news follows BuzzFeed’s journey to the public markets through a blank-check company. Hot media liquidity summer? Something like that.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

That TechCrunch is in the process of being sold to private equity, of course, is not something that we should forget. Shoutout to the Verizon bankers who found a way to get rid of us while also deleveraging Verizon’s debt profile. Ten points.

I want to take a quick tour of the Forbes SPAC deck this morning. Our notes on BuzzFeed’s are here, in case you want to run comparisons. This will be easy and fun. Perfect Friday morning fare. Into the data!

I want to take a quick tour of the Forbes SPAC deck this morning. Our notes on BuzzFeed’s are here, in case you want to run comparisons. This will be easy and fun. Perfect Friday morning fare. Into the data!

What’s it worth?

In corporate-speak, Forbes Global Media Holdings is merging with blank-check company Magnum Opus Acquisition Limited. The transaction will close either Q4 2021 or Q1 2022, Forbes estimates.

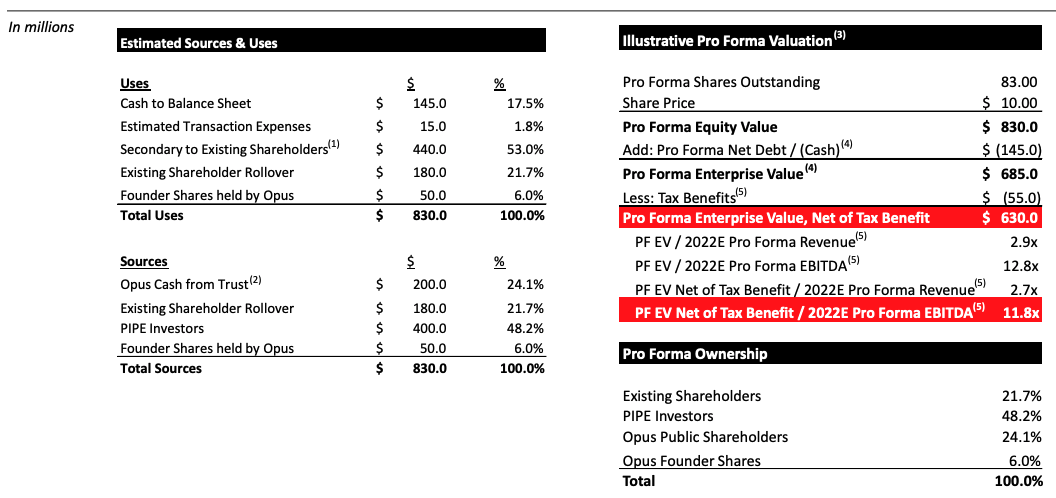

The deal itself is somewhat modest in scale compared with other SPAC deals we’ve recently looked into. Forbes reports that it will sport “an implied pro forma enterprise value of $630 million, net of tax benefits,” after its completion. Some $600 million in gross proceeds will be derived from Magnum Opus funds “and $400 million of additional capital through a private placement of ordinary shares of the combined company,” Forbes writes.

The company will sport an equity valuation of $830 million after the deal closes, per its own calculations. That number will change some depending on redemptions ahead of the combination. The gap between the large dollars going into the deal and the modest final valuation of the public Forbes entity is due to some $440 million in secondary transactions for existing Forbes shareholders.

In case you’d prefer all of that in table form, here’s the Forbes investor deck:

Is $830 million a fair price? Let’s dig into Forbes’ results.

Fading print, rising digital

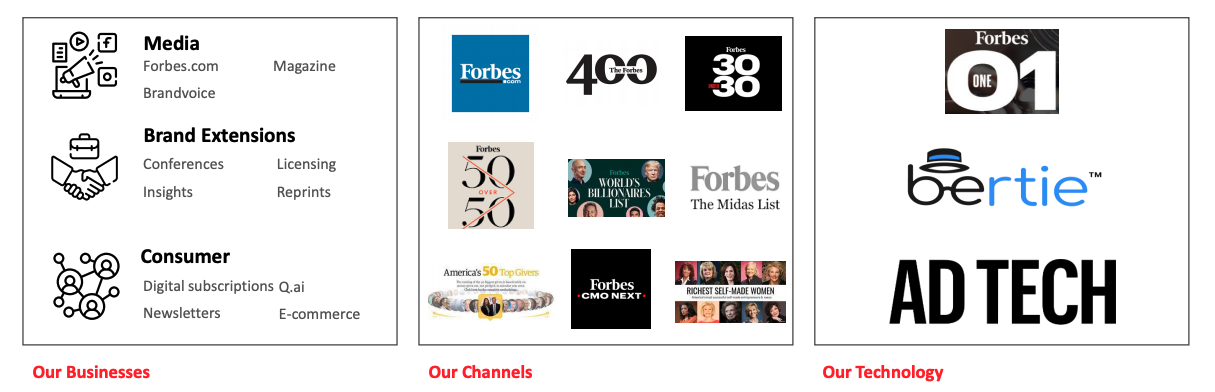

You may think of Forbes mostly as a magazine, or perhaps mostly as a website. Neither is correct. Forbes is both and quite a lot more. Here’s the key slide from its deck regarding its product mix:

What we might best understand about Forbes — its media business — is merely a fraction of its larger work. The company’s other efforts, brand extensions and the blandly labeled “consumer” category, are also key revenue drivers for the business.

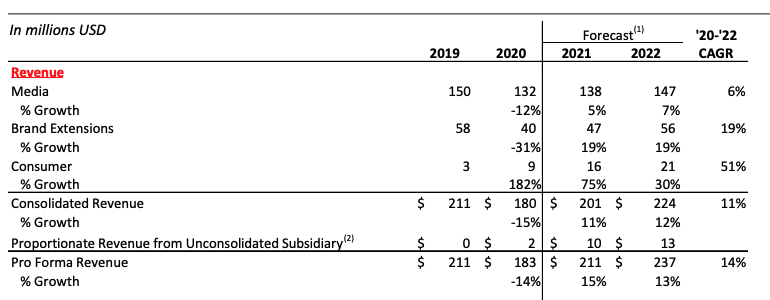

The larger mix shakes out as follows when it comes to historical and anticipated performance:

From a high level, we can see that the media element of Forbes remains its largest revenue category, but its slowest-growing segment when it comes to expected future results. Brand extensions, the company’s second-largest revenue bucket, will grow at a multiple of media’s pace, but from a smaller base. And consumer revenues are expected to grow the fastest, from the smallest base of the three.

It isn’t uncommon to see smaller, and thus more nascent, revenue groups grow more quickly than larger, more established parts of a business. But in the case of Forbes, it’s all the growth there is to see. The company doesn’t anticipate that its media business will be larger in 2022 than it was in 2019, in revenue terms. In a sense, media is the past of Forbes, or perhaps the foundation for its future. Because while media itself will merely mount a recovery from its COVID-induced lows over the next year and change, the businesses that Forbes’ traditional media efforts allowed to grow will muster its real growth.

So, what are brand extensions and consumer? Our first image indicates brand extensions are a mix of conference incomes and other revenue sources that stem from media efforts. Consumer, as well, includes some media incomes, albeit sectioned out from other media revenues to allow their growth to stand alone. Accounting gimmick or valid separation? We leave that up to you.

Brand extension work also includes licensing the Forbes name to others so that they can use it to build publications, for example. Also in the mix are e-commerce efforts (Forbes Shopping), a marketplace and an investing app called Q.ai. Consumer efforts include subscriptions and the stuff that some of us find less exciting from the larger Forbes business, including “exclusive invitations” and “membership recognition.”

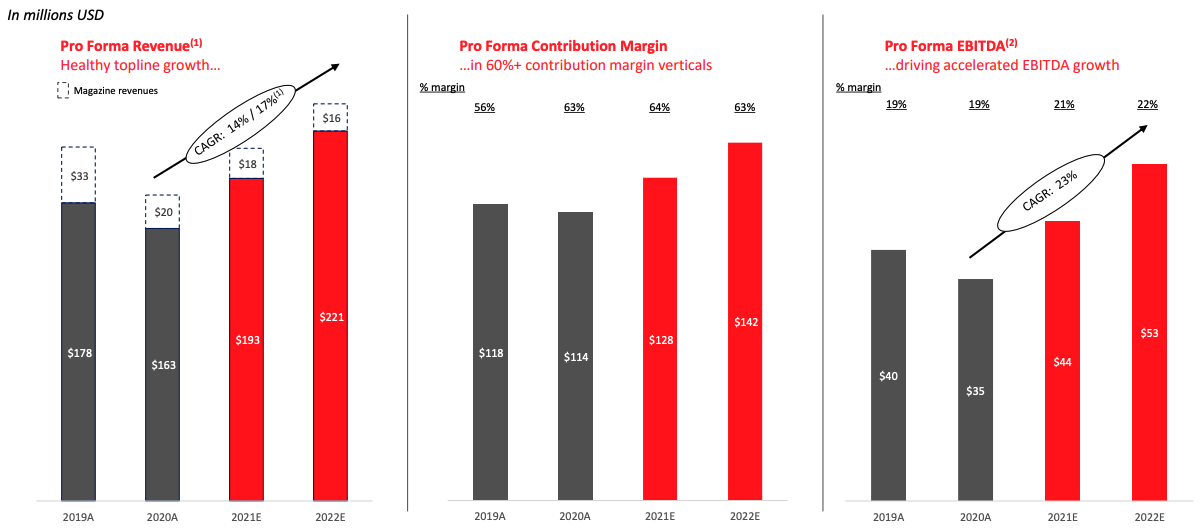

Here’s how it all that shakes out in chart form:

The chart on the left better details the impact of COVID-19 on Forbes, and how its magazine business is rapidly becoming a rounding error in its larger profile. The second chart paints a hopeful picture of contribution margins staying largely flat as revenue expands. And the final chart is a pledge of sorts to drive greater adjusted profitability over time, getting to 22% pro forma EBITDA margins next year.

Over the long term, Forbes expects is media business to fall to 45% from 65% of revenue in the 2020-2022 period, and its consumer and brand extension work to expand from 35% to 55% of revenues. The company also projects 25%+ long-term EBITDA margins.

To sum up, Forbes isn’t growing too quickly at just 14% compounding off its COVID-19 lows, though it does anticipate better profitability through 2022.

And it thinks that its 2020 revenue result of $183 million is worth $830 million in equity terms, or around 4.5x trailing top line. The company’s revenue multiple should compress to around 3.9x this year. That doesn’t feel exorbitant, but it also doesn’t feel inexpensive. Why? Because Forbes’ ex-magazine revenue will only scale 24% from 2019 through 2022. That’s pretty modest. And we aren’t sure how the company’s EBITDA will convert to net income over time, so the Forbes profitability picture is not entirely clear.

Still, the Forbes SPAC deal does make some sense; it provides liquidity to existing shareholders, adds cash to the Forbes books and will float the company in a generally warm market for debuts, even if SPAC-led combinations have struggled in recent months. Is it the most exciting debut? No. But it does highlight that with enough sheer gumption, one can take a magazine business into the digital age and keep aggregate revenue growing. That’s worth something.

Comment