David Jegen

More posts from David Jegen

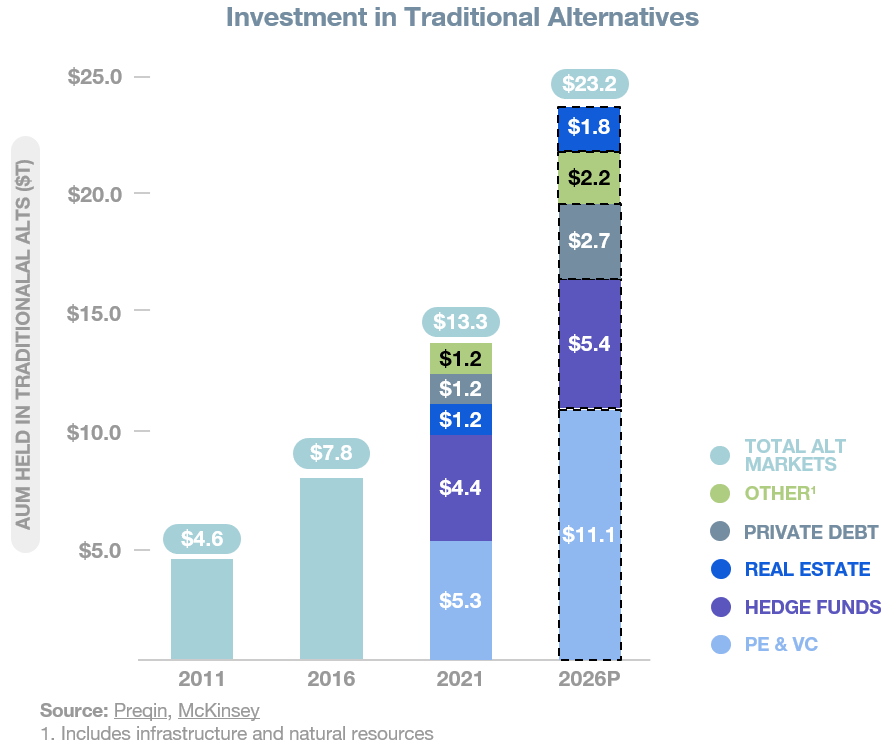

It took more than 30 years for alternative asset classes like venture capital, private equity and hedge funds to become must-have portfolio allocations, but they have finally arrived in force. Private investments in alternative assets grew to $13.3 trillion from $4.6 trillion over the 10 years ended 2021, and advisers now routinely recommend allocating 10%-25% of portfolios in these asset classes.

Liquid alternative asset classes are enjoying record inflows, and B2C-friendly distribution platforms like Moonfare, Fundrise and SeedInvest are building on-ramps for a new generation of investors.

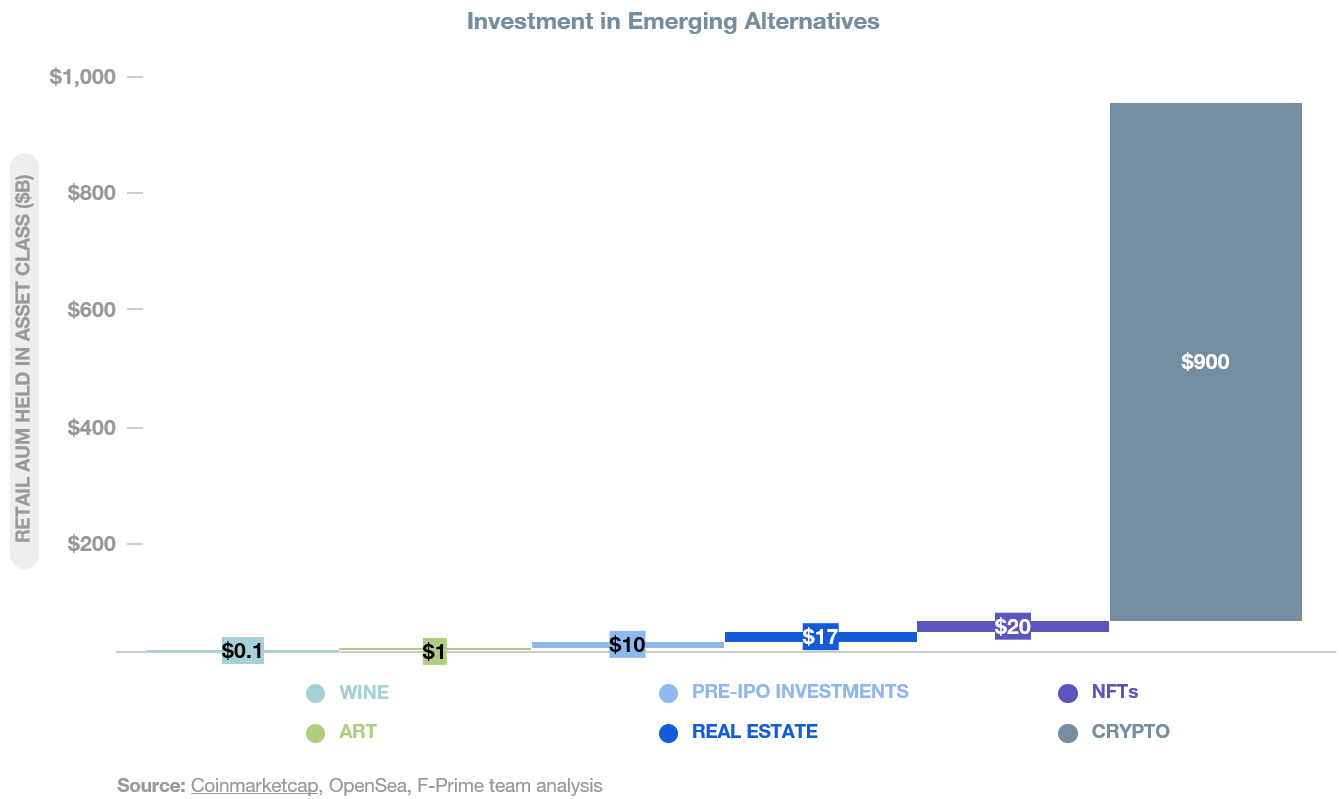

Just as these traditional alternatives are becoming a consistent part of the modern investment portfolio, a new era of alternative assets is emerging, fueling an even broader and more fragmented landscape for investing. Dozens of platforms have launched to fractionalize, package and distribute everything from farmland, litigation finance and P2P lending to art, wine and collectibles.

Crypto added fuel to this trend and quickly became a mass-market asset category. Together with more established alternative classes like venture capital and private equity, these new alternatives give retail investors unprecedented access to asset classes that either never existed (like crypto) or were previously limited to high-net-worth investors.

However, there is a problem in alternative assets: the lack of digital infrastructure. Traditional alternative assets like venture capital and private equity at least have an ecosystem built to serve them, but that infrastructure is aging and built for a narrower base of institutional investors, like endowments, pension funds and large family offices.

As these asset classes scale and diversify their investor bases, they need a serious upgrade to modernize the fund manager/GP and investor/LP experience. The situation for emerging alternative assets is far worse. Today, investment platforms cobble together their operations — sourcing, brokerage, reporting and custody — while investors endure fragmentation throughout their journey of discovery, account creation, execution and reporting.

Let’s start with traditional alternatives

Yes, it’s oxymoronic to call alternatives “traditional,” but after more than 70 years, over $13 trillion in AUM and 10%-25% portfolio allocations, it’s hard to say that venture capital, private equity, private credit and real estate are novel forms of investment.

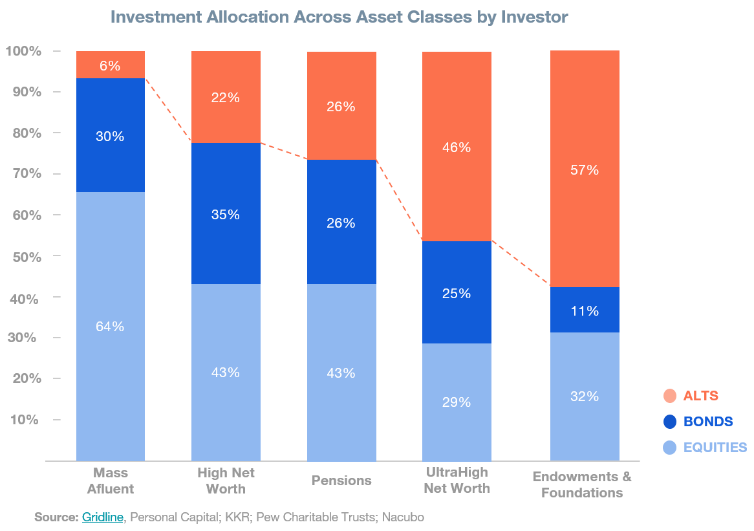

Investment performance for “traditional alts” is even highly correlated with public equities. The most enduring distinction is the accredited investor requirement (just 10% of the U.S. population), but Reg CF, Reg A+ and a myriad of platforms like SeedInvest and WeFunder are prying open that door as well.

As these asset classes scale, fund managers are systematically diversifying their investor bases beyond institutional investors like pension funds and endowments. The old and labor-intensive processes built around 30-year tech stacks from FIS Investran, State Street and Citco will not scale to 100,000+ financial advisers and millions of accredited investors. What’s more, the user experience is so bad, you would not want to scale it: PDFs, manual bank wires and clunky investor portals are the current “state of the art” here.

Modernizing the infrastructure for traditional alts

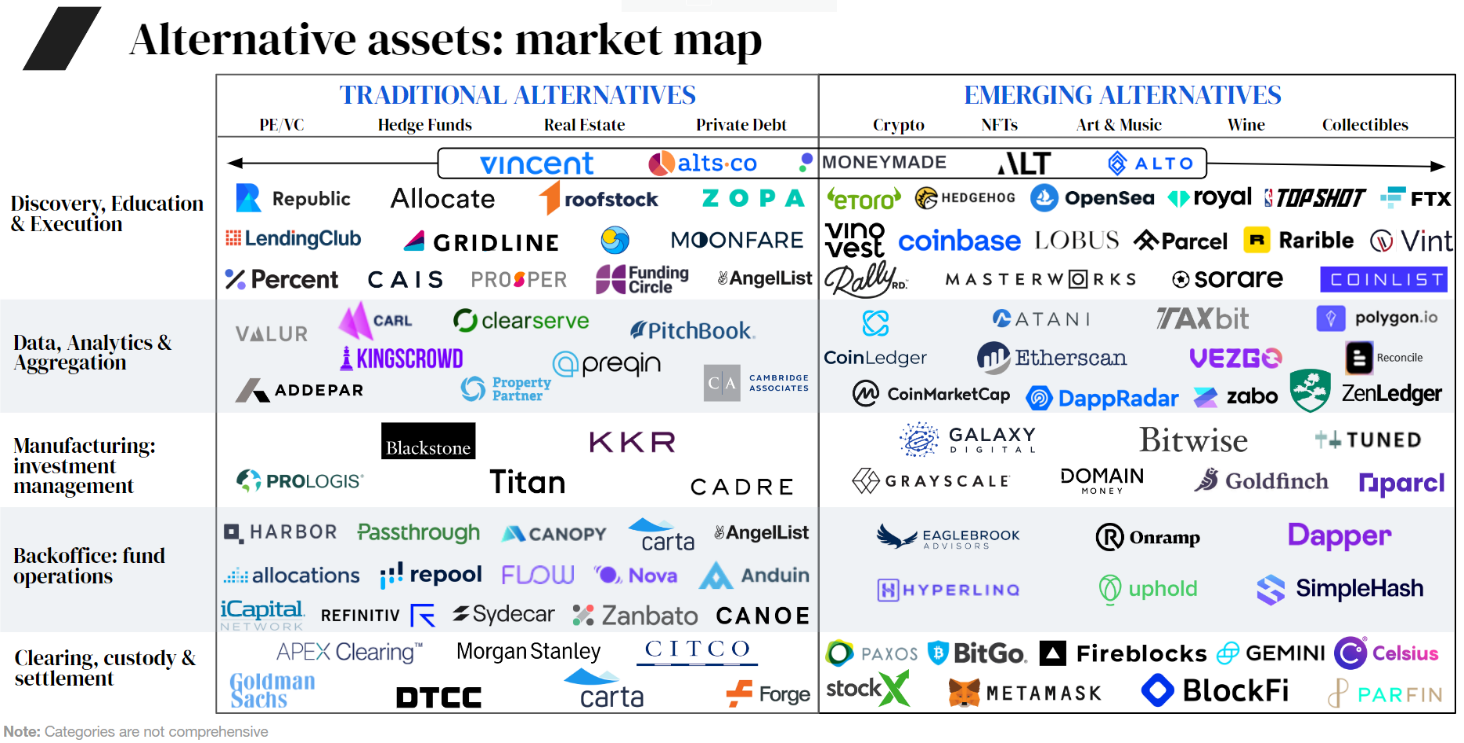

Fortunately, entrepreneurs are tackling the problem posed by antiquated infrastructure for traditional alternative investments.

User experience

A natural entry point is the GP-to-LP (general partner to limited partner) user experience. Fundraising, LP onboarding, subscription documents, CRM and capital calls are highly visible user experiences that can be digitized and improved without touching the underlying fund infrastructure. Startups like Canopy, Flow, Asset Class and Sydecar offer delightful experiences to VC and PE fund managers and their LPs.

Back office and fund operations

For every dollar spent on the user experience, more than 5x is spent in the back office on accounting, investment monitoring and fund administration. Fund managers will not migrate off SS&C, State Street and BlackRock/eFront easily, but modernizing these processes with software that integrates external and internal resources, reduces double entry, maintains a single source of truth and automates reporting is critical to scaling.

Owning this also means a long-term sticky relationship. Aduro, Sudrania, Carta and Juniper Square have all made inroads in this backbone of the alternative asset class.

Data, analytics and aggregation

Ask an alternative asset fund manager about analytics and you’ll probably get a blank stare. That’s because LPs have long suffered quietly with their fund performance PDFs, thinking it was their responsibility to extract structured data and analyze investment performance across dozens of funds.

Tools like Addepar and Canoe Intelligence have helped, but today’s startups need to build API-first structured data models that make LP analytics a first-class citizen.

Network effects

Finally, for startups that build and execute well, there is an obvious opportunity for network effects.

Much like how Carta did this for startups and investors, we will see network effects build among GPs and LPs. Eventually, we will hear an LP ask a GP to “please use X because I already have my other fund investments there.” This position must be earned and is still likely to be winner-take-most, not all. But it is still an exciting reason for startups to build in this area.

The rise of alternatives

As traditional alternative assets have matured, a new menu of alternatives have emerged, offering all investors (retail and accredited) access to novel, fast-growing and less correlated asset classes. Some of these have always been available to wealthy investors but are now being fractionalized and virtualized to grant access to retail investors.

Examples include private credit, project finance, art, music and wine. Others, like real estate and collectibles, were already available to retail investors but are now more accessible and liquid than ever. Lastly, crypto, an asset class unto itself, has given all investors a new asset with a variety of novel and unfolding value propositions.

Any one of these emerging alternative assets is relatively minor, but in aggregate, they are worth about $1 trillion (despite recent sell-offs). They have attracted more than 120 million users globally and given birth to more than a 100 distribution platforms.

While they present less correlated investment return potential, another tailwind is that they tap into investors’ growing desire to have a personal connection with their investments, which could be values based or stem from intellectual curiosity. This hybrid investment-personal activity became clear with Kickstarter and Indiegogo, and these new alternative asset platforms scratch a similar itch.

The missing infrastructure for emerging alternatives

Very little of today’s infrastructure is suitable for these emerging alternative classes. Incumbent custodians like Pershing and National Financial do not custody the assets; brokerages like Charles Schwab and Morgan Stanley/E*Trade do not allow trading of these assets; financial adviser platforms like Orion and Black Diamond do not integrate with new platforms, exchanges and funds.

Consequently, investors and platforms have had to cobble together their own tools and infrastructure. Active investors can have 10 or more accounts, one for each platform on which they invest, all with separate account funding, tracking and reporting. Trading platforms have had to vertically integrate from customer acquisition to custody — think leasing secure and disaster-resistant warehouses for physical assets, or self-custody for many crypto tokens.

Here are five areas that need to be developed, and startups are beginning to go after them:

Discovery, education and execution

After a point, markets usually see aggregators emerging to tame fragmentation and provide consumers with consolidated gateways. Fidelity and Charles Schwab do that well for traditional asset classes, and players like Vincent and MoneyMade have just begun to do something similar for these newer alternative classes.

More importantly, investors need a single account from which to invest. While traditional brokerages could expand into these markets, it is more likely that an existing platform like Coinbase or one of the discovery-centric aggregators will act first and expand into a full-service, multiasset-class brokerage.

Over-the-top aggregators like LiquidFi and Stacked are headed in this direction, too, and modern retail fund structures like Titan are also positioned well.

Data, analytics and aggregation

This industry needs a Morningstar. When the mutual funds industry surged in the 1980s, Morningstar helped standardize and normalize the criteria for evaluating mutual funds. It gave retail investors confidence and financial advisers cover.

It will not be easy to do the same across so many asset types, but consistent measurements of risk, volatility, liquidity and reputation are possible. For these asset classes to scale, they will need institutional capital, actively managed funds and financial advisers — and all of these depend on better data.

Data foundations exist in some asset classes — we have Coinmetrics and Kaiko for crypto; DappRadar for NFTs; and Art Market for art — but investors need a trusted source of normalized investment metrics across all the alternative asset classes.

Manufacturing: Investment management

Speaking of managed funds, the long-term weight of these asset classes will come from actively managed funds.

Actively managed funds account for about 80% of market capitalization in equities, and even more in fixed income, FX and commodities. Early movers like Grayscale, Galaxy and 21Shares have captured over $75 billion in AUM, and there is room for many successful players with a variety of strategies. This will be a fee-rich category.

Custody, clearing and settlement

The unsung heroes of investing are custody, clearing and settlement. Investors take them for granted in equities, debt and FX thanks to centralized institutions like the DTCC, CLS and CME, as well as the numerous incumbent financial institutions with clearing operations. Investors in the new alternatives cannot.

Investors in physical assets accept the risk that the platform they use to buy is also world class in storing and protecting their assets (also known as custody). Even when investors purchase fractionalized art or collectibles on sites like Rally or Vinovest, there is still the underlying risk of owning physical assets.

Crypto custody risks are those of self-custody (do not lose your physical storage device or private key), and if you use online brokerages like Coinbase, which do not carry SPIC insurance, your assets are not even legally yours in the event of a brokerage bankruptcy.

Clearing and settlement is better, though still fragmented with smaller custodians and transfer agents, which results in reporting and tracking complexities. The blockchain has played a valuable role in clearing and settlement for crypto and fractionalized assets, and will do so for other emerging alternative asset classes, too.

This fragmentation and lack of insurance is a natural part of an industry’s path to maturity, but to scale, we need to see diversification and consolidation right from the brokerage and execution layers through to the clearing and custody plumbing.

In the meantime, expect aggregators like MoneyMade and Stacked at least to fill the aggregation gap for investors, giving them visibility into their disparate holdings.

The opportunity for startups

Traditional alternatives are diversifying their investor base from a few thousand institutional investors to millions of accredited investors and their advisers, while an entirely new class of emerging alternative asset classes require entirely new infrastructure. Indeed, even as alternatives form a $1 trillion asset class, the sector’s platforms and their investors are cobbling together discovery data, reporting and clearing and custody where incumbent institutions have failed to step forward.

The alternative asset investment industry has never been more exciting, but it needs serious investment in new infrastructure to scale and improve the investor experience. Now is an exceptional time to build category-defining companies.

Comment