Buy now, pay later is everywhere these days, mostly focused on the consumer.

Resolve — a San Francisco-based startup in the space specializing in “buy now, pay later” capabilities for B2B transactions — announced today that it has raised $60 million in funding. Initialized Capital led the round — the company’s first funding since its 2019 inception. KSD Capital, Haystack VC, Commerce Ventures, Clocktower Ventures and others also participated.

The funding is a combination of equity and asset funding according to co-founder and CEO Chris Tsai, although he declined to reveal the breakdown.

Since launching as a spinout from Affirm in 2019, Resolve says it has seen “overwhelming” demand for its B2B buy now, pay later (BNPL) billing offering for business purchases. Notably, the two companies refer business to each other. Tsai describes Affirm founder Max Levchin as a “friend” with whom he has been working in a variety of capacities since 2012. (He’s also reportedly an investor in the company.)

Unlike Affirm — which is more focused on the consumer — Resolve is exclusively focused on business-to-business billing by automating the process of billing and purchasing on credit. What it’s doing is basically allowing businesses to defer payments digitally and on better terms than what they’ve seen historically via an automated underwriting process, the company claims. This, it says, can lead to faster invoice payment and thus, improved cash flow.

The company also claims it can offer extended payment terms with buyers not having to pay any interest or fees if accounts are repaid within the agreed-upon terms. Meanwhile, merchants receive full payment (minus any fees) as soon as an order is placed.

In the ‘buy now, pay later’ wars, PayPal is primed for dominance

Resolve offers businesses payment terms ranging from 30 to 90 days and gives them more control of their billing and cash flow, according to Tsai. While he declined to give specifics around any growth metrics, he said the company has seen a “significant and meaningful” uptick in growth in the wake of the COVID-19 pandemic because of so many businesses’ shift to digital e-commerce. For example, one of its customers is a bike merchant that had to expand into online selling in the wake of the pandemic.

“This is not a new transaction type, but being able to do it in this new digital or e-commerce way of buy now, pay later, like Affirm — that’s very new and in fact it’s still very much not the norm yet,” he told TechCrunch. “But we’re finding, especially post-pandemic, incredible demand for switching to more digital e-commerce payment formats.”

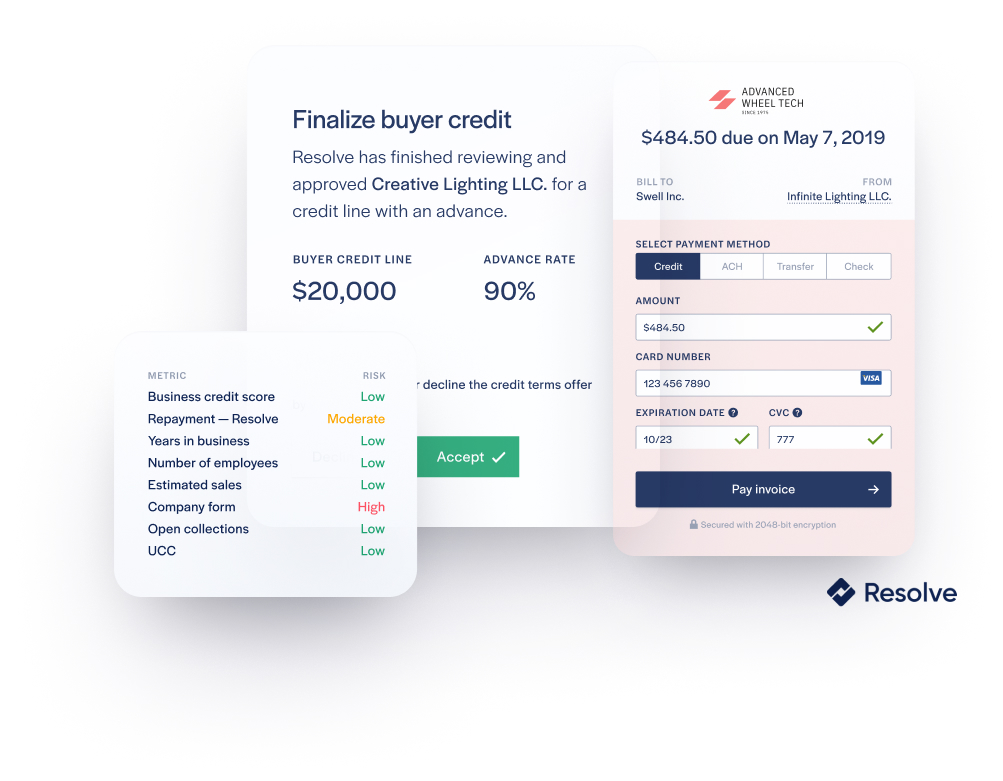

Among Resolve’s features is a “Smart Credit Engine,” which the company says creates a direct sync with a merchant’s real-time data feed of past payment histories to allow for “immediate” credit line decisioning with no input required from buyers.

Its embedded bill payment portal gives its B2B customers a way to pay vendor bills “while building their business credit history” bureaus, the company says.

“Digital and e-commerce transformation is coming for B2B payments,” Tsai said. “Growing companies must balance heightened demand for deferring payments from their business customers with their own limited capacities to satisfy that demand.”

The embedded nature of Resolve’s platform gives it an edge, Tsai believes, in that it integrates into a company’s existing financial tech stack. The benefit to the business, he said, is increased growth and sales revenue as well as optimized cash flow “while removing risk for the company.”

Initialized Capital General Partner Alda Leu Dennis said she was familiar with Tsai and co-founder Brian Nguyen since their days at Celery, their prior startup. She views them as experienced and determined.

“We also have conviction around the clear market need for digitizing net terms for small businesses that are increasingly moving their ordering online,” she said.

In her view, Resolve’s unique differentiation is that it provides software that solves net terms billing complexity.

“Businesses desperately need to manage their B2B billing operations, from helping them gauge the strength of their customers to chasing down payments,” she told TechCrunch. “Their [Resolve’s] approach of accelerating payments and collections via software and offering payment terms as an ancillary service is a powerful pairing; it provides an easy yet comprehensive way for merchants to improve their entire system of managing receivables and billing on credit.”

The San Francisco startup is using the money primarily to grow its embedded billing platform.

“We’re doing a lot of work to scale the platform. So we’re investing heavily in products and the customer sides of the business, given all the demand that we’ve seen,” Tsai said. “The operations software that we’ve built is very seamless for our customers, but there’s a lot going on in the background that we have to do to reduce the complexity for our customers.”

Comment