Grab a cup of coffee and strap in, because this pitch deck teardown is pretty different from most of the ones I’ve done to date.

Why? Let me count the ways. (OK, fine, there are only two ways.) But let’s take a closer look:

1. This is a blockchain pitch. The pitch deck is for Simba Chain, a blockchain company that raised $25 million in a Series A. It’s hella brave of them to submit their deck for a teardown. If you follow me on Twitter, you’ve probably noticed that of every three or four tweets, one has me making fun of blockchain tech.

It isn’t that I hate the people who build blockchains, but in the decade or so that I’ve been following the industry, I have come across only a tiny handful of companies that make sense to me (Arkive is one, and I did a teardown of its deck, too). Most of the time, I conclude that it’s a crying shame that people this talented are throwing away their time and talent building something in this space.

I know those are harsh words, and I hasten to add that that’s my personal opinion, not that of TechCrunch overall. (Besides, you wouldn’t want me writing about this when we have an incredible crypto/blockchain/web3 team covering it.) I did want to mention it, because as much as I’ll try to be neutral, my disdain for blockchain tech will almost certainly show through in this teardown.

2. TechCrunch didn’t cover the round! I know, I know, that’s pretty much one of the rules here for the pitch deck teardowns. Having said that, The Wall Street Journal covered the round, as did CoinDesk.

Suffice it to say that I’m stretching my knowledge to the max here, but I invite you to consider two things:

- I don’t have to have a deep understanding of blockchain tech to be able to critique the pitch. In fact, many of the people who buy my book and who work with me as a pitch coach are running companies in spaces I know nothing about.

- Storytelling is universal, and as long as the founders know what they’re talking about, I can help with the pitch side of things.

So here’s an invitation: Let’s see this as an adventure we can go on together, and if you have feedback, thoughts or comments, feel free to write them on a piece of paper and set it on fi … I mean, feel free to make fun of me on Twitter. I promise to be open-minded.

With all of that out of the way, let’s learn some stuff together!

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Simba Chain’s slide deck is incredibly impressive and covers a lot of ground. It consists of 19 slides, some of which sneak up on you with a surprise, and others that might leave you scratching your head.

- Cover slide

- Problem slide

- Solution slide

- Market slide (TAM/SAM)

- Market slide (SOM)

- Vision slide

- Traction slide

- Awards

- Team slide

- Board of directors slide

- Scaling Simba slide

- Positioning slide

- Competition slide

- Moat slide

- Competition product comparison slide

- “Invoke Smart Contract Method” slide

- Supported blockchains slide

- Current investors slide

- Thank you/contact slide

Three things to love

There are two ways to make money in a gold rush: One is to dig out a giant honking nugget of heavy, yellow metal; the other is to supply the miners with picks, shovels and TNT.

I love how explicit Simba Chain makes that it is doing the latter — and not just for anyone, either. The company has been working with an incredible list of customers, including ones (such as the U.S. Navy) that are notoriously hard to land contracts with. In the pitch and storytelling, Simba Chain leans on its customers’ pedigree to make its story come to life.

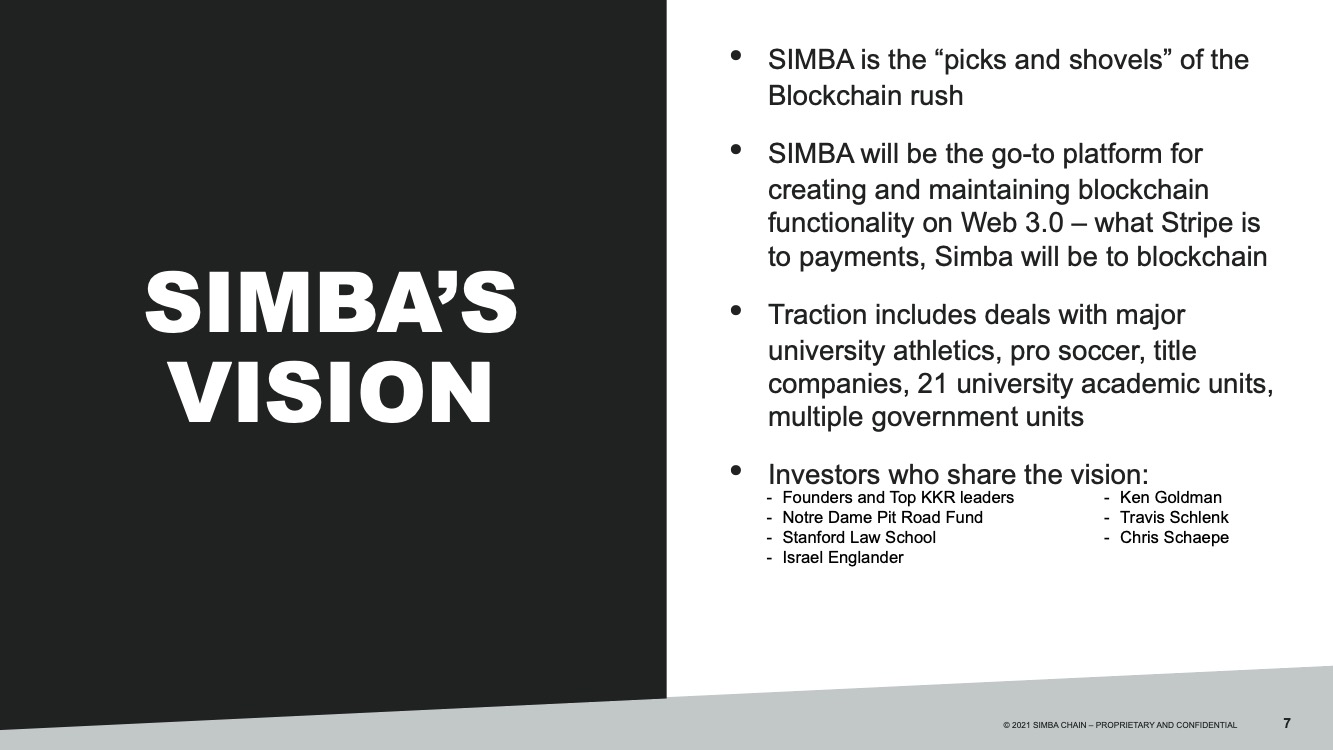

Crystal-clear vision

A lot of companies find it surprisingly hard to figure out their raison d’etre. When you’re an early-stage startup running a blue-ocean strategy, a thousand opportunities come your way at every turn. Cutting through the noise with a clear, strategic vision, followed by implementable tactics and repeatable operations, is the way to build a fast-growing, successful company.

This vision slide has an abundance of clarity: “‘Picks and shovels’ of the blockchain rush” is ChefsKiss.gif, and “What Stripe is to payments, Simba will be to blockchain” nails it down harder. I wish that this was the second slide because it gives even a chain skeptic like myself a reason to nod my head and mutter, “I see what you did there,” under my breath.

There’s a couple of head-scratchers here, so I’ll quickly name them: I have no idea what traction or investors are doing on a vision slide — it dilutes the message and muddles the story. If the last two bullets on this slide were moved elsewhere, this would be a perfect setting-the-tone slide for this pitch.

As it is, it’s merely extraordinarily good, so we’ll let the founders off the hook here.

Holy team, Batman!

In a world where diversity matters, this slide earned an eye-roll from me. But then I started reading the descriptions.

I’ve never seen anything like, “Bryan has been involved in 380 startups and 17 exits” on a slide deck before. It seems like he was pulled in as part of the Series A after serving as the company’s board chairman since its late-2019 seed round. A claim like “380 startups and 17 exits” will have any investor looking up Ritchie’s LinkedIn page.

There seems to be a bit of a disconnect there, and I suspect the founding team had an interesting time in due diligence. Still, the company successfully raised the money, so they passed due diligence, and if the company can back up the claim, it speaks to a lot of experience for sure.

The rest of the team is stacked with veterans, too. The CTO had been in IT academia for a decade before co-founding the company, and the COO spent 25 years at Microsoft before joining Simba Chain (although it appears he’s recently moved on to Google).

The co-founder and ex-CEO, Joel Neidig, has an impressive resume as well, although “addressed the president’s economic council on blockchain” is somewhat fuzzy — I don’t know what that means. In any case, it appears he left Simbla Chain in July, along with COO Joe Matz.

This slide is pretty wild. I haven’t spoken to the company, as I’m trying to do these pitch deck teardowns as prima facie as I can, but there seems to be more to the story than you’d think at first glance.

If I’d come across this deck when the company was raising its round back in 2021, I’d have said, “There’s a lot of veteran talent here.” Looking at it with the benefit of August 2022 eyes, though, the picture is interesting: The CEO wasn’t there when the fundraising happened (he was promoted from board chair to CEO as part of this round), and two of the remaining seven folks on the deck have moved on.

My read is that the company brought in veteran leadership, which caused a shake-up. That’s not a bad thing — companies expanding rapidly often outgrow their founding team and early employees — but it would certainly make me conduct deeper due diligence than usual to make sure there isn’t a cultural problem here.

In any case, the company currently lists 91 employees on LinkedIn, so it looks like it has been on a hell of a trajectory since its early days.

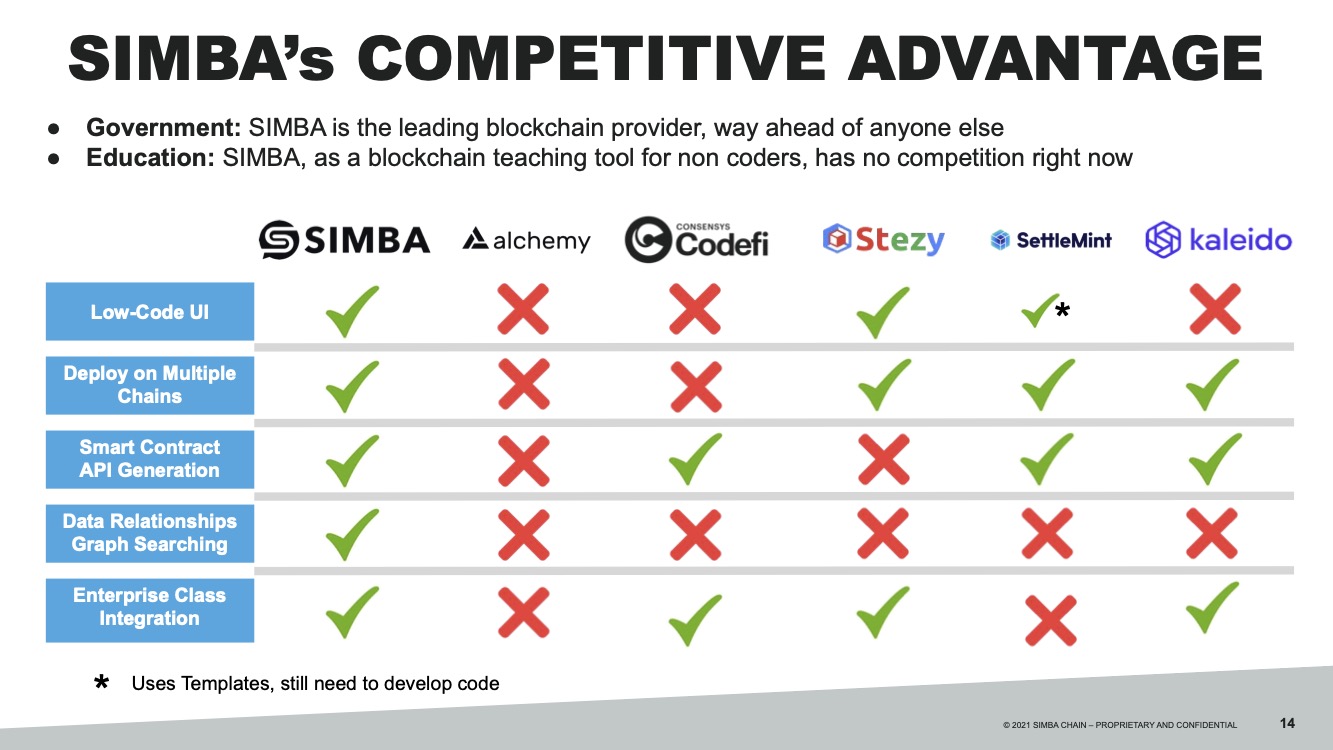

A beast of a competition slide

Blockchains and web3 are rapidly evolving spaces, both in terms of market acceptance and technology. It helps that Simba Chain was originally spun out of a DARPA contract and has a gathered credibility from being associated with established, well-respected academic organizations. This means it has a head start on making itself palatable for governments and enterprise customers alike.

Of course, the company wasn’t going to add anything to its own competition slide that doesn’t show it coming out on top. Even so, this is a rather impressive way to start a conversation. Follow-up conversations would be around why these points are so important to government customers and how that translates to overall competitive advantages.

Of course, investors will want to check whether Simba truly is way ahead of everyone else and that there is really no competition for no-code options. That said, this slide does something particularly elegant — by mapping out the competitive landscape in this way, you are able to guide the first pass of the competition conversation in your direction. Very clever and undoubtedly elegant.

In the rest of this teardown, we’ll take a look at three things Simba Chain could have improved or done differently, along with its full pitch deck!

Three things that could be improved

I say this every time, and I’ll say it again: $25 million doesn’t lie — the pitch deck worked. This deck has some doozies in it, though, so let’s pick some of them apart:

Where’s your traction?

I really don’t want to be rude, but slides 8 and 9 are god-awful. The top right of Slide 8 has a little corner that says, “5,000 users and growing,” and the rest of the slide is a ton of blue-chip logos, along with the words “government, enterprise, supply chain, education.”

The slide (on its own) simply doesn’t make sense, and it’s unclear whether the logos are partners, customers or what have you. If you have 5,000 customers, your traction slide ought to be graphs of number of contracts, number of users, amounts of revenue or any number of other real traction metrics. As it stands, it’s a wall of logos and no story, which made me wary.

It got a lot worse when I got to Slide 9, though; the “awards” listed here are the kind of thing I’d expect from a two-bit early-stage company. “Best new tech in Indiana” is something you put on a slide deck when you are scraping the bottom of the barrel and have literally nothing else.

Suffice it to say that the awards may be worth celebrating internally, but they don’t fulfill the prime directive for a pitch deck: Does this information help an investor make an investing decision?

Put differently, as a general rule, unless you won a Nobel Prize, awards aren’t traction and probably shouldn’t be in your slide deck.

Wait, excuse me, what?

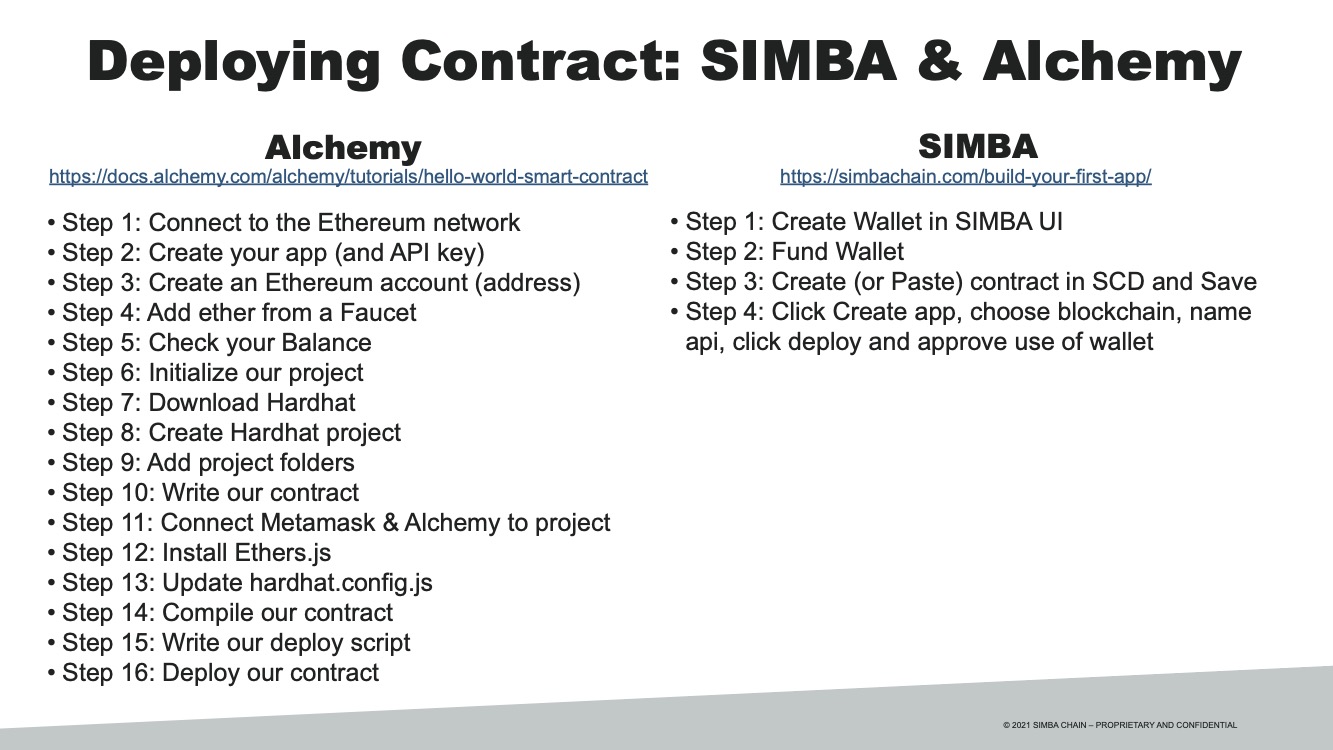

Slides 16 and 17, I think, are meant to illustrate how easy it is to use Simba Chain. On Slide 16, it shows how Alchemy has a 16-step process. Half of it doesn’t make sense to me, but I’ll give the company a break here. It’s complicated.

I’m delighted that Simba’s deployment is a four-step process. Step 3 reads “Create contract in SCD,” and the company lost me. I don’t know what an SCD is. I tried Googling it, but there appear to be a whole bunch of SCDs, so that didn’t really help. In a nutshell, I get that the 16-step process is too many steps, but the four-step one doesn’t look that much easier to me.

The real kicker is that step 4 reads: “Click create app, choose blockchain, name API, click deploy, and approve use of wallet.” I may not understand blockchains or smart contracts, but I can count. Step 4 appears to have five steps in it, which puts a serious dent in the message here.

Zooming out a little from the tactical to the strategic, there are two things to remember: Your investors aren’t necessarily domain experts nor are they your customers. I get what the company is trying to do, and four steps is fewer steps than 16 steps, so that’s encouraging, but you’re still losing me along the way. I almost let this slide, er … slide.

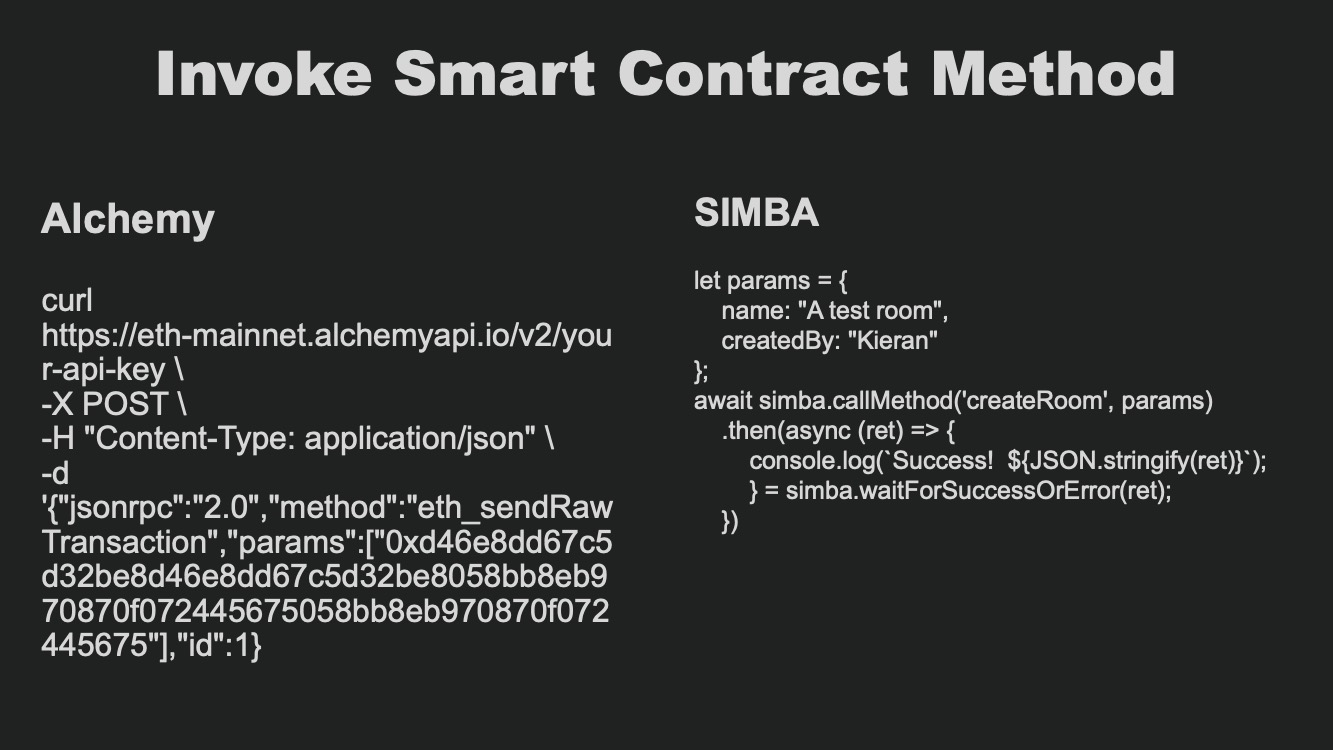

But then came slide number 17, which is a white-on-black block of text, showing how much easier it is to use Simba than Alchemy. As a non-coder, both of these blocks of text are completely impenetrable. I think the founders are trying to show how much easier it is to use Simba than its competitor, but neither of those look easy to me.

The overarching piece of advice here is this: Remember you are talking to investors. They need to understand the business behind what you are doing. If you are showing command-line screenshots or blocks of JavaScript on your slides, think really hard about why and what purpose it serves.

A better way of telling this story might be visually with a flow diagram that makes the number of steps clear. Or perhaps ask 10 users to figure out how to deploy a contract on Alchemy and Simba, time them and report the time saved.

In any case, I invite you to think about the audience and the message you are trying to convey. If it’s easier, faster, cheaper or better, just say that and save the coding for a live demo. Better still, leave coding to the coders and wave some juicy charts of a bank balance hockey-sticking up and to the right.

Which reminds me…

Where’s the “business” part of this pitch?

Nowhere in the pitch deck is money mentioned. At all. The company doesn’t say what it’s raising. It doesn’t mention business models. It doesn’t show financial projections, operating plans, hiring plans, revenue numbers, growth projections, or, in fact, anything to do with money at all.

This is bizarre. A $25 million Series A is all about growth; showing that you have a functional, repeatable business model that means you’re off to the races. A pitch deck that appears to pretend that money doesn’t exist and doesn’t outline anything about what the company is planning to do with the money, is super weird. I went through the deck a number of times. I even carefully checked the form Simba Chain filled in when it submitted the pitch deck for review — the company noted that the deck is “exactly as used.”

It’s possible that the blockchain world is more alien to me than I care to admit, but I do know startups and storytelling. To raise money, you need to explain how you’re going to spend the money you raise and outline how you’re going to make money at some point.

I’ll be honest: I have no idea how this company raised $25 million without mentioning what its plans are, and that’s the truly impressive thing about this pitch deck. It worked and I haven’t the foggiest idea how.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice.

Comment