Welcome to the week!

Sure, the technology and business worlds are busy digging through a deluge of Facebook-focused reporting ahead of the social media company’s earnings report, but we have other work to do.

Namely, the Braze IPO filing. The New York City-based company focuses on customer engagement software. We’ll get into what that means in a little bit.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

For background, Braze raised around $175 million while private, most recently raising a September 2018 round that put $80 million into its account and afforded Braze an $850 million post-money valuation. PitchBook and Crunchbase agree on the numbers.

Our task this morning is to understand what Braze does, get our hands around its financial performance, and then chat a bit about what the company may be worth. Sound good? Let’s do it.

Our task this morning is to understand what Braze does, get our hands around its financial performance, and then chat a bit about what the company may be worth. Sound good? Let’s do it.

What does Braze do?

In broad terms, Braze links with customer software systems to collect consumer data, automatically sorting consumers into segments. From there, the company’s software can send “contextually relevant” notes to consumers, personalized based on what Braze has learned about the person or persons in question. Those messages can be sent both inside of customer products or outside through third-party channels.

The underlying logic is that consumers expect customization today, and that data is the way to pull off the task. Braze makes lots of noise in its filing about how many companies’ customer data is siloed inside individual applications today. In contrast, Braze offers a method of centralizing consumer data, which, in theory, allows for a more holistic view of a customers’ consumer base. With that view in hand, customers can make better marketing decisions, with Braze helping companies get tuned messages out to end users.

As you can imagine, we’re talking about a software-as-a-service product, though the company does have a dusting of on-demand revenues, which we’ll get to in the next section.

Braze’s service has a large in-market footprint. The company claims in its S-1 filing that it powered “interactions with 3.3 billion monthly active users via our customers’ apps, websites and other digital interfaces in July 2021.” That figure was 2.3 billion in January 2020 and 1.6 billion in January 2019.

How does that rising usage of the Braze platform translate into revenue? Let’s find out.

Is that a good business?

Braze is a pretty good business.

The company has released data through the July 31, 2021, quarter. We should get an early look at its October 31, 2021, quarter in a following S-1 filing.

For the six months ending July 31 of this year, Braze recorded $103.6 million in revenues, up just under 53% from its year-ago period, when it racked up $67.9 million in top line. That growth rate represents a modest decline from what the company managed in its most recent fiscal year. The 12-month period ending January 31, 2021, saw Braze generate $150.2 million in top line, up 56% from $96.4 million in the preceding fiscal year.

Still, 53% growth from a nine-figure revenue base is more than sufficient to go public with, even if growth measured in percentage terms has slowed somewhat.

Because Braze is a software company, it has strong gross margins, although its gross profit as a percentage of revenue does not land in the upper echelons of SaaS firms. In the six-month period concluding July 31, 2020, for example, Braze had gross margins of 64%. In the same period of 2021, that figure rose to 67%. That’s the right direction.

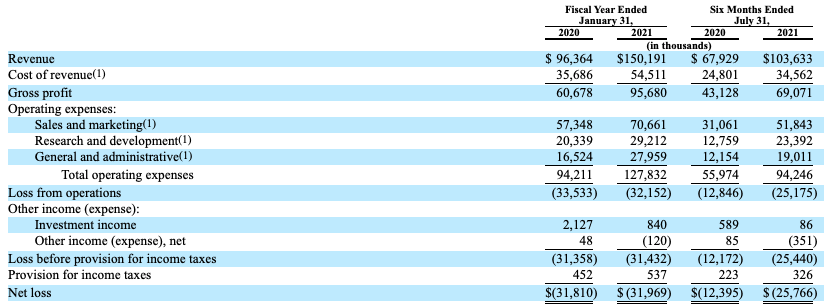

Still, the company’s net losses are rising at the same time. Observe the Braze income statement:

Net losses are rising thanks to costs going up faster than gross profit.

As you can see, operating costs rose sharply at the company in its most recent two-quarter period when compared to year-ago totals. Sales and marketing costs rose 67% in the six months ending July 31, 2021, while research and development costs expanded 83%. General and administrative costs grew slowest among Braze’s operating cost segments, at 56% on a year-over-year basis.

In the company’s favor, however, share-based compensation costs rose from $2.7 million in the two quarters closing July 31, 2020, to $12.6 million in the same period of 2021. So, a good chunk of the company’s net loss gains were non-cash.

Notably, Braze doesn’t have a suite of complicated adjusted profitability metrics on display. It isn’t trying to hide behind aggressive adjustments to the already non-GAAP EBITDA metric, a very popular method of tuning results to make unprofitable companies appear less icky.

Instead, Braze lists net loss in its opening S-1 pages and sticks to the metric (at least in our first read of its S-1). Doing so implies that the company’s leadership and business are mature enough to go public.

Software specifics

Now let’s talk SaaS. While Braze sticks to GAAP metrics for its overall reporting, it does provide some software-specific metrics that are worth consuming.

First, what portion of the company’s revenues came from software, and what pieces came from services?

Subscription and professional services fees comprised 93.2% and 6.8% of our revenue, respectively, for fiscal year 2020, 93.9% and 6.1%, respectively, for fiscal year 2021, 93.1% and 6.9%, respectively, for the six months ended July 31, 2021 and 93.8% and 6.2%, respectively, for the six months ended July 31, 2020.

Those numbers are static — and pretty good.

Keep in mind that the company’s software revenues are recurring. The “subscription” moniker gives that away, but it’s still worth unpacking. Here’s how Braze talks about its software revenue mix, with bolding from TechCrunch to underscore why we don’t have to spend too much energy thinking about the company’s on-demand revenues in contrast to its recurring incomes:

Subscription services primarily consist of access to our customer engagement platform and related customer support. Our customers enter into a subscription for committed contractual entitlements. To the extent that our customers’ usage exceeds the committed contractual entitlements under their subscription plans, they are charged for excess usage, or they may exercise an option to purchase an incremental volume tier of committed contractual entitlements. … Fees associated with excess usage and incremental volume are also treated as subscription revenue. To date, fees associated with excess usage have not been material.

Because “usage” revenues are non-material, we can discount them. But it will be interesting to see if, over time, Braze keeps its strong SaaS focus despite rising acceptance, and perhaps nearly preference, for on-demand pricing that we’ve seen in certain software sectors of late.

Sticking to SaaS metrics for now, let’s talk net retention. Braze, continuing the theme of grown-up metrics, appears to have a non-bullshit net retention definition. While some companies try to deduct churned customers from their numbers to make themselves look better — at the cost of S-1 reader trust, I’d argue — Braze’s calculations include “any expansion and [are] net of contraction or attrition.” Good.

With that in mind, here are the numbers:

Our dollar-based net retention rate for the trailing 12 months ended July 31, 2021, January 31, 2021 and January 31, 2020 was 125%, 123% and 126%, respectively, for all our customers, and 135%, 133% and 127%, respectively, for our customers with ARR of $500,000 or more.

The back half of that comment matters because Braze is seeing rising revenue concentration over time. But given that net retention among larger customers is greater than what the company sees with smaller accounts, revenue concentration changes make sense.

How concentrated is the company’s revenue base? Somewhat, but nothing lethal:

[A]s of July 31, 2021, we had 41 customers with ARR of $1.0 million or more, up from 31 and 18 customers as of January 31, 2021 and 2020, respectively, accounting for approximately 37%, 33% and 25% of our ARR, respectively.

No single customer is 5% of Braze’s revenue, so logo risk is somewhat low even if losing one or two of its larger customers would make any single quarter a bit messy.

The company’s strong net retention numbers among large customers, along with lower rates of expansion in smaller accounts, are a key driver of growth at the firm. Braze reports that 54.5% of its revenue growth in the six-month period closing July 31, 2021, compared to its year-ago equivalent was “attributable to the growth from existing customers.”

To sum up: Braze is growing nicely at scale with modest net losses and no smokescreen-y, fake profit numbers on display. It has middling margins for a software company, but they are improving. And its net retention numbers are pretty good, greatly helping its overall growth profile.

Now let’s talk value.

What’s it worth?

Braze generated $55.8 million in total revenue during the July 31, 2021, quarter. That works out to a run rate of $223.0 million. A quick review of market data indicates that companies with growth rates in the 50s often trade in the mid-30s, when it comes to revenue run-rate multiples.

A 30x run-rate multiple would value Braze north of $6 billion, a huge number considering that the company’s final private valuation landed under the $1 billion mark. We’ll know more with the company’s next filing, which may include Q3 data, though likely in preliminary form.

Comment