The business of building for and selling to developers is big. Startups around the world are busy creating new developer-focused — or at least developer-forward — solutions at a rapid clip.

The “developer tools” tag on TechCrunch has been busy this year. We’ve covered recent news in the space from Hardhat, CodeSee, Harness and Gadget, to share a few individual items.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

The concept of selling to developers is attractive. Many startups are building in an API-first way, creating tools and services that software engineers can hook into their existing products or workflows. This creates a dynamic where sales are often self-serve and pricing is based more on usage than the per-seat model that SaaS made ubiquitous.

Investors are also enthused by building stuff for developers and selling directly to their end-user. Data indicates that more than $37 billion went into developer tools startups last year, a huge sum for any category.

Investors are also enthused by building stuff for developers and selling directly to their end-user. Data indicates that more than $37 billion went into developer tools startups last year, a huge sum for any category.

The space we’re describing is broad, including companies like Hashicorp, which went public last year and builds developer tools relating to infrastructure and security. GitLab also went public last year on the back of its git-style code repo service for devs. And Samsara went public as 2021 came to a close, selling IoT solutions to developers, including an API.

You might think that with venture capital piling into the technology business model category and a number of recent IPOs to point to, the market for such work would be hotter than ever. And yet.

Boldstart Ventures’ Ed Sim noted yesterday that public developer- and infrastructure-focused startups are seeing their valuations fall in recent quarters:

Some perspective on fast growing developer first + infra startups

Hashicorp once valued >$14B now $6.7B, ARR run rate $322M

Gitlab once valued >$15B now $5.5B, ARR run rate $268M

Founders, if u haven't adjusted valuation expectations, u better

100x NTM is over for 99% of cos pic.twitter.com/NdLr6ure2L

— Ed Sim (@edsim) March 8, 2022

Naturally, this got us thinking, as the wave of 2021 venture capital that developer-first products raised was partially predicated on that year’s public market-signaled valuations. And those have come down dramatically. The trend is not precisely new, though recent data does make the point very clear.

It’s worth mentally circling back to the C3.ai IPO from late 2020. The company’s growth story was a little odd, and its pricing was seemingly a little rich. Then it shot out the public-market gate like a racehorse, pushing its valuation into the stratosphere. Since then, however, things have changed.

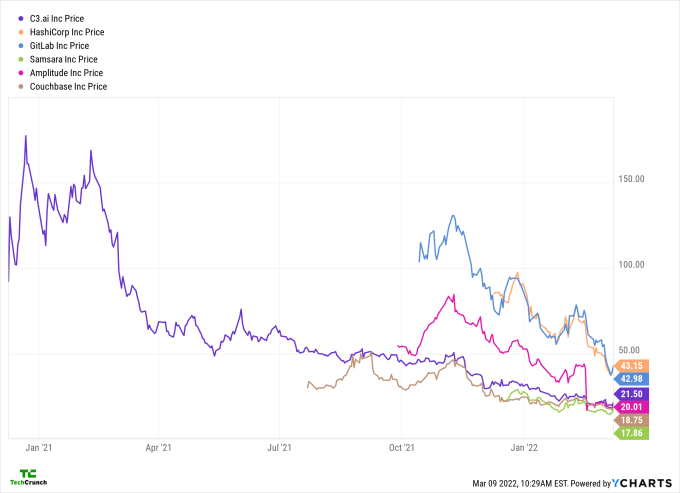

Here’s a chart of C3.ai’s share price performance since launch, with Hashicorp, GitLab, Samsara, Amplitude and Couchbase in the mix as well, joining the chart when they went public (data via YCharts):

You can see that C3’s post-IPO pop was not long for the world, with the company’s share price entering a long-term decline just a few months later. However, that initial enthusiasm pop did not warn investors in other hot developer-first IPOs from making similar trades in later debuts.

Selling to developers could be considered a sort of product-led growth. That’s what Amplitude stressed to The Exchange in calls around the timing of its direct listing and its first-quarter earnings report (which went poorly, for what it’s worth). There’s overlap. Product-led growth is when the use of a product leads to a net-new sale or positive net retention (this is where usage pricing comes in). It’s easy to see how developer-first and product-led growth occupy shared space; selling to developers is often predicated on offering a free tier to an API, for example, so that devs can mess around and tinker. That’s using product to lead growth, right?

Product-led growth is a big deal these days as startups are trying to find ways to grow without spending all their capital on advertising and sales staffing. So when we say that public markets and perhaps some private-market investors have mispriced developer-first companies in a few key examples, we’re also saying that product-led growth is no panacea.

The point? Startups should not expect a valuation premium simply because of their developer-first status or because they have a product-led growth model that appeals to end-users who write code. Companies that employ one of the business methods and use it to generate above-average growth, above-average gross margins and above-average profitability will enjoy a premium to market norms. But due to results — not their choice of business model.

The days of sunny optimism are somewhat behind us. We’re not in a startup winter, not really. But we are in what Natasha Mascarenhas calls a re-correction, a reversion to prior norms, even if those norms are still somewhat rich by historical standards.

Comment