Jason Wenk

Fintech founders that set out to solve big problems for consumers almost always begin with the best intentions — they want to help people. But they often miss that mark by a country mile, which spurs questions about how effective other fintech founders can be at helping consumers. Trust me, when you name your for-profit, venture-backed fintech startup “Altruist,” a certain amount of healthy skepticism follows you around.

That skepticism is understandable because, in many ways, the world of fintech is built on a foundation of internal conflict. The vast majority of fintech founders deeply appreciate the power and value of hyper-profitable business models in accomplishing less clearly profitable goals. Many come from finance backgrounds, giving them an insider’s advantage at identifying the ways financial tools and institutions do not benefit — and sometimes exploit — consumers.

Founders quickly identify the problems and have the skills to fix them, so they lock in and start building a solution to help people. Their intentions are, by and large, altruistic.

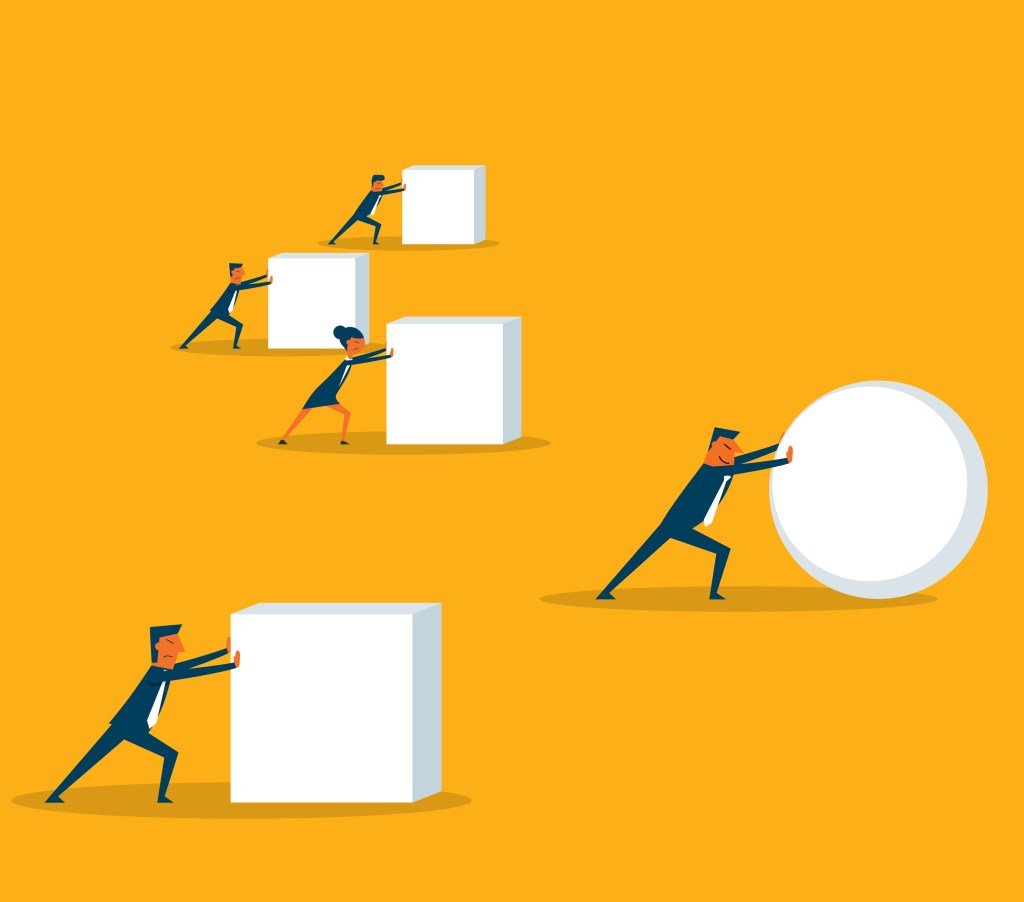

This is where things start to get more complicated for fintech founders. The same industry know-how and business understanding that helped them identify problems to solve will drive many down a path that abandons their initial mission.

So where do altruistic fintech founders lose their way? What market forces turn their “disruption” into the same archaic business models? And, most importantly, how can they be avoided?

Avoiding the exploitative path

The first step that any fintech founder must take is to right-size their addressable market, and this doesn’t just mean identifying a widespread need. “We want to help people begin saving” is a great mission statement, but any founder must be realistic about how to deliver on this need.

If your business model means that you have to generate revenue equal to 200+ basis points from your addressable market, it may cost too much money for the people you set out to help. In short, you have to get the math right.

The unit economics of your business are such that it costs too much money to acquire customers based on the assets of that customer. To make the math work, you have to generate an enormous amount of LTV, and because the customers you want to help don’t have enough money, you have to charge massive fees.

If you really look at the business models of many consumer fintechs, particularly savings products, their fees are often effectively 5% a year. That’s not far removed from predatory lending.

In effect, they’re saying, “We’re going to get you to use our product and charge you on such small transactions that you don’t notice that you’re never really getting ahead.”

Worse, a lot of founders travel down this exploitative path without ever realizing it. Getting the math right should be your first step, but there’s no wrong time to sit down and give it another hard look to see if there’s another path.

Venture pressure and shiny objects

If you find yourself on the wrong side of the addressable market “math,” you leave yourself open to the next, dangerous, fintech founder trap: the “get big quick” scheme.

The venture markets have made it so frothy to be in fintech, and there are huge pressures to use the same playbook to scale up an organization to raise a lot of money. Unfortunately, this approach often leaves the customer hanging out to dry.

For example, one major fintech company that automates investing, buying and spending has a noble mission and has also publicly said that it expects to earn 1% across all assets. That’s a high fee and almost twice as much as many non-digital platforms.

But if you really do the math and charge a truly “disruptive” quarter of a percent, $5 billion in assets is only a $12 million business. Investors don’t want to create small companies, and $12 million is a small company. At 1%, suddenly, you’re a unicorn with the ability to change the world.

Getting big quickly like that can lead to overpriced products that hold consumers back and “mission creep.” The founder that sets out to help people save money may turn into the founder who tacks a high-fee crypto investment service onto their product. Why? Because crypto offered a faster path to growth and funding at that time.

That eagerness to raise funding is another quick path to losing your way. When founders do a bunch of rapid funding rounds (safe notes or traditional preferred equity raises), they often find themselves owning a de minimis percentage of their own company.

At that point, you’re locked into “growth at all costs” and have to build a monster to see any benefit.

Solving for C by going B2B

Of course, some of the founders reading this column are likely already mid-flight. You sized-up your addressable market as best you could, you took the funding you needed and chose your investors. There may be very little you can do to manage the risks already laid out above.

That said, there’s still one too-often-ignored path for an altruistic founder to help consumers — addressing the root cause rather than the end result.

There are few more complex and personal problems than a consumer’s relationship with their money. Too many companies think they can carve out one consumer pain point to somehow create systemic change, and a better financial life for someone — they identify a consumer problem and think that the solution must be a direct-to-consumer play.

Whether it’s solving saving, budgeting or investing, all of these solutions are well-meaning and well-executed, but are the finance equivalent of “solving” insomnia with bedding.

I don’t mean you need to ignore consumers’ problems, but you might help them most by focusing your vision beyond what the average person deals with in their day-to-day lives.

The difficulties people face in saving money can be solved by developing new banking systems. The challenges people have in making it to payday can be solved by working with employers and improving their payroll solutions. The struggles of wealth management can be eased by giving advisers better technology to help their clients.

Best of all — solving business problems means you can better avoid the other fintech founder traps. Right-sizing the addressable market of a B2B solution is far less prone to delusions of grandeur. There are far fewer distracting shiny objects and “fast growth” tricks in the B2B world. The investors backing B2B fintechs tend to be more patient and reasonable in their expectations for runway and ARR.

You may still find yourself releasing a consumer product eventually, but you’ll have achieved the proper stability and scale to serve consumers effectively by that time.

In many ways, the best path to help consumers is looking beyond them.

Comment