Shifting investor priorities, more expensive cash and a dearth of the large deals that were so common during the last startup boom could leave many late-stage web3 companies short on cash. And the clock is ticking.

People are already memeing that venture capitalists have pivoted from crypto to AI, hunting, as they’re wont to, for the next big thing. For startups stuck in a now passé category, watching venture dollars flow elsewhere cannot feel great, even if such evolutions in capital flows are normal.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

TechCrunch recently dug into venture capital data to understand how investor interest in web3 companies is faring in 2023. We also sought to glean what we could from similar searches for AI-related startup fundraising.

What did we learn? Well, the data indicates that web3 companies’ ability to raise private capital has flatlined to a fraction of its former pace (perhaps by as much as 80% in Q1 2023 if trends hold). The picture for AI-related funding is a bit less clear.

What is limpid as glacial melt is that there are a good number of late-stage startups — in web3 space and others — stuck between their last funding event, the price set during the transaction and a new market reality in which investors don’t seem too interested in funding their efforts further.

What is limpid as glacial melt is that there are a good number of late-stage startups — in web3 space and others — stuck between their last funding event, the price set during the transaction and a new market reality in which investors don’t seem too interested in funding their efforts further.

We’ve touched on the matter before and even recently wondered how far off the unicorn death cliff is. Happily, we can bring our question concerning the terminal cash date for formerly richly valued startups and the changing genre focus of the venture market together this morning.

Recently, tech investor and founder Elad Gil penned an interesting piece on cash balances at companies that raised money during the final go-go quarters of the 2021-era venture zenith:

Many companies are likely about to meet a hard reckoning. This is likely to start end of 2023 and accelerate through end of 2024 or so. The likely timing is +/- 6 months. It is based on when companies last fundraised at scale, 2021, and how much runway they raised. [ … ]

There is likely a mix of companies who have raised anywhere from 2-4 years of cash in 2021 that will not grow into prior valuations, and will need to find an exit or shut down. As such Q3 2023 through end of 2024 (and maybe part of 2025) seems roughly when these companies will start to seek exits and or shut down.

In retrospect, we could have done this math ourselves, but it’s nice to see someone with community weight do the calculations — it lends the numbers more credence.

How does Gil’s note fit into our question regarding web3 startups and the latest venture shift to AI-predicated neo-tech companies? It nests because web3 companies rode the 2020-2021 venture crest hard.

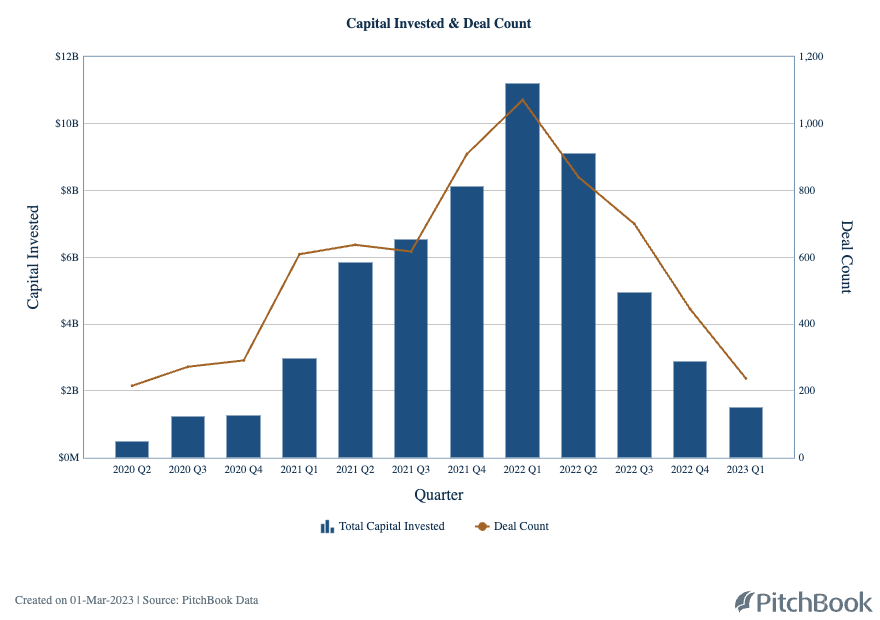

Recent data from Bain makes the point clear: Noting that investors “poured approximately $94 billion into web3 companies in recent years, most of it since 2021,” the report also shows a dramatic collapse in funding to companies building for the ostensibly decentralized world. I ran a PitchBook search for venture-backed companies in the web3 and blockchain markets to verify Bain’s dataset and wound up with a very similar chart:

Funding on a monthly basis (not shown above) for the company set in question fell to $750 million-$800 million in the last three months from a peak of around $4.5 billion in March 2022. That’s a dramatic, painful collapse in funding for the larger, more richly valued and presumably less profitable web3 startups, but it’s not good news for early-stage web3 startups either.

Recall Gil’s point: Startups that raised through the 2021-era boom are going to start running short of cash en masse later this year. That leaves nearly no time for venture trends to turn around.

What’s more, Bain’s data notes that a large portion of venture capital (let’s say 40%, going by eyeball calculations) that flowed into web3-ish startups during the last boom was late-stage money. The implication? There are a lot of web3 unicorns that are already effectively dead, living out a few quarters of hospice care as they hope for crypto to rise again.

But crypto just might come back. I don’t think anyone wants to be the person who anti-predicts the next crypto boom — I have seen so many since my first piece on Bitcoin back in 2013 — but that’s different from needing a return to the Good Times right now to save one’s startup bacon.

After absorbing the above, I’m guessing we are heading toward a web3 death cliff that could be even sheerer than what we expect for unicorns.

Closing the circle on changing venture interests, what about generative AI and the current clamor to put capital to work in that market? Are we seeing a similar sort of investment wave?

Not yet, per PitchBook: The data indicates generative AI companies aren’t going to even set a local quarterly maximum for fundraising in Q1 2023. Sure, investors are hot and/or bothered by the new tech’s possibilities, but we’re still far from the sort of mania we saw around crypto a few years ago.

Perhaps it will lead to more sustainable companies in the long run.

Comment