News broke yesterday that Substack, the popular newsletter publishing tool, called off fundraising plans for a Series C after a raise at its price target failed to materialize. The company’s revenue base, when compared with its hoped-for valuation, was too small to support the numbers that the startup had in mind.

This is not a unique story. Many startups that raised at high prices last year will run into snags as they try to attract capital at new, higher valuations. The why in this case has been the topic of conversation in technology circles for months now. In short, market conditions that led to a venture capital bonanza last year have slowed or reversed, leaving many startups sitting on private-market valuations that no longer translate to present-day investor appetite.

TechCrunch+ is having a Memorial Day sale. You can save 50% on annual subscriptions for a limited time.

Substack is striking a combative tone with media coverage of its fundraising exploits, telling The New York Times — which broke the news of the company’s Series C attempt — that its comment on the story was its jobs page. Certainly, Substack still has capital and is hiring, but that it wanted to raise more funds is also illustrative.

The Substack Series C saga is a good moment to refresh ourselves on just how much the market has changed. And what’s more, we can go back in time and vet our prior coverage of the company’s finances, grading what we mathed out when it last raised. Everyone is going to look a little silly, so let’s get into it!

The Substack Series C saga is a good moment to refresh ourselves on just how much the market has changed. And what’s more, we can go back in time and vet our prior coverage of the company’s finances, grading what we mathed out when it last raised. Everyone is going to look a little silly, so let’s get into it!

Valuation mechanics

Recall that Substack last raised a $65 million Series B at what PitchBook described as a $675 million post-money valuation. Here’s the latest from the Times on what the company wanted to raise in a Series C:

Substack held discussions with potential investors in recent months about raising $75 million to $100 million to fund the growth of its business, said the people, who would speak only anonymously because the talks were private. Some of the fund-raising discussions valued the company at between $750 million and $1 billion, they said.

Notably, if Substack had raised $75 million at a $750 million post-money valuation, it would have been effectively a flat round from its Series B. That that valuation appears out of reach today implies that the only way that Substack would be able to raise a new round of equity funding would be with a valuation cut. Down rounds are not popular, so it isn’t a surprise that the company put its fundraising plans on hold at least for now.

Why did Substack struggle to attract high eight to low nine figures of capital at a nine- to 10-figure valuation? Because it had a seven-figure top line last year, the Times reports, writing that “Substack has told investors it had revenue of about $9 million in 2021.”

That nugget lets us do some interesting math:

- Substack EoY 2021 trailing revenue multiple at Series B valuation: 75x.

- Substack trailing revenue multiple at the time of its Series B raise: Far greater than 75x.

Those are lofty prices, even for 2021, helping explain why they are not translating well to the 2022 investing climate, which is far more morose and demanding than what startups enjoyed last year.

Let’s presume for the moment that Substack is set to double its revenue this year, reaching $18 million in calendar year top line in 2022. At its current valuation of $675 million, its trailing multiple would only land around 38x. Regardless, even with double its 2021 revenues this year, Substack’s Series B valuation appears rich; if the company had raised at an even higher price in a Series C, the math would have been even harder to parse.

Why? Because Series C valuations are in decline, as is the size of such deals in cash-offered terms. Carta data, for example, indicates that median Series C valuations were off 3% on a year-over-year basis in the first quarter, while median cash raised at Series C was off 14% compared to the year-ago quarter. As the Q2 venture capital market is looking weaker than it was in Q1, those numbers are likely a bit rosier than where we actually are today.

Public-market comps are in the toilet, technology shares are generally less favorable than before, and investors are looking for results from late-stage startups that show a path to cash flow breakeven and an IPO. Substack, with $9 million in 2021 revenue, is simply too small to raise a late-stage round at effectively a unicorn valuation today.

Who is to blame? You could say that Substack’s prior investors put too much capital into the company too early, giving it a price tag that it now cannot defend. You could also put the onus of guilt on Substack itself, given that it found it prudent to go fundraising again so quickly after its last round. Or you could argue that the Substack model itself simply won’t scale to the size needed to support the company’s vision, meaning that both investors and founders got it wrong.

There I quibble. I think that Substack has hit on something material and could build a real company out of it. But I do wonder if its growth rate will prove venture-backable. In time, Substack may reach public-market scale, but perhaps not quickly enough for venture demands to work.

Recall that Substack takes a 10% cut of customer revenues, allowing us to loosely estimate that its platform GMV last year was around $90 million. That’s a lot! And ripping $9 million from that total to power what is effectively a software business (with some writer-specific tooling and support added in) is good business.

But it cost a lot of money to get to that $9 million mark. PitchBook indicates that Substack has raised $86.21 million to date, a number very close to its 2021 estimated platform spend. That’s a lot of capital input for the listed output. I wonder if Substack had to spend — through its Pro program, for example — heavily to accelerate its market so that it could scale its revenue base at a pace that its backers liked.

More simply: Is Substack spending to grow its TAM more rapidly than its market’s natural rate of growth? If so, while the company was correct that it had identified a niche worth exploiting, it may not be a market slice that is amenable to venture-speed revenue expansion.

It wouldn’t be the first time that a media business with a software component ran into such issues.

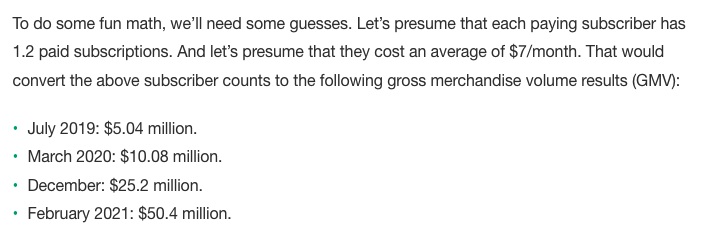

So how far off were our estimates of Substack’s scale back when it raised its Series B? From our coverage at the time, using company-disclosed subscriber counts to get some estimates:

Our back-of-the-envelope math got us to an estimated $50 million worth of GMV for the company last February, and Substack wound up closing the year at what we loosely estimate now to be around $90 million in GMV. We weren’t that far off, though the faster Substack grew last year, the more we have may have overestimated its early 2021 GMV.

Regardless, Substack is now likely comfortably over the $100 million GMV mark — it has, we presume, kept growing since the end of 2021 — putting its revenue run rate over the $10 million threshold. That’s a nice milestone for any business. But at a $1 billion valuation, the upper end of what the company discussed with backers, it would be valued at 100x current revenues. That’s just not a price that flies anymore.

At this point, I wonder where a16z is in all of this. The investing group led Substack’s Series A and B and is still able to raise huge sums for new deals. Why isn’t it tripling down? One reason we can summon is that a16z overvalued Substack last year and doesn’t want to put more capital in at either the same price or a higher valuation. Or that a16z is now a web3-focused shop, meaning that its prior investments into media are passé?

Perhaps Substack should launch a cryptocurrency to get its former backer excited about its efforts once again.

Comment