Large supermarket chains have their own purchasing and logistics functions, but there are thousands of small, independent grocery stores and chains. They typically don’t have the benefit of the specialized software and tech to help make everything run smoother, but that’s where Vori saw an opportunity.

The company agreed to share the pitch deck it used to raise a $10 million Series A so I can take a closer look. (It also wrote a bit more about the fundraise on its own blog.)

For this pitch deck teardown, it’s helpful if you have a bit of context for why Vori makes sense as a business, and it’s pretty awesome to see its founder outline how the company works — and how he thinks about building a piece of B2B software that “is as fun to use as Candy Crush.” Below is a five-minute video that tells the story beautifully. I only watched it after I did the pitch deck teardown so as to not let my critique be affected by the video, but it’s good enough to watch before or after should you want to dip a little bit deeper into this particular industry.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Vori shared 13 slides, redacting a little bit of information.

“We removed some in-the-weeds data about growth loop conversion metrics,” the team told me, “along with sales cycle/revenue traction.”

- Cover slide

- Mission statement slide

- Vori-at-a-glance — (KPI slide, lightly redacted)

- “We understand grocery” — interstitial slide

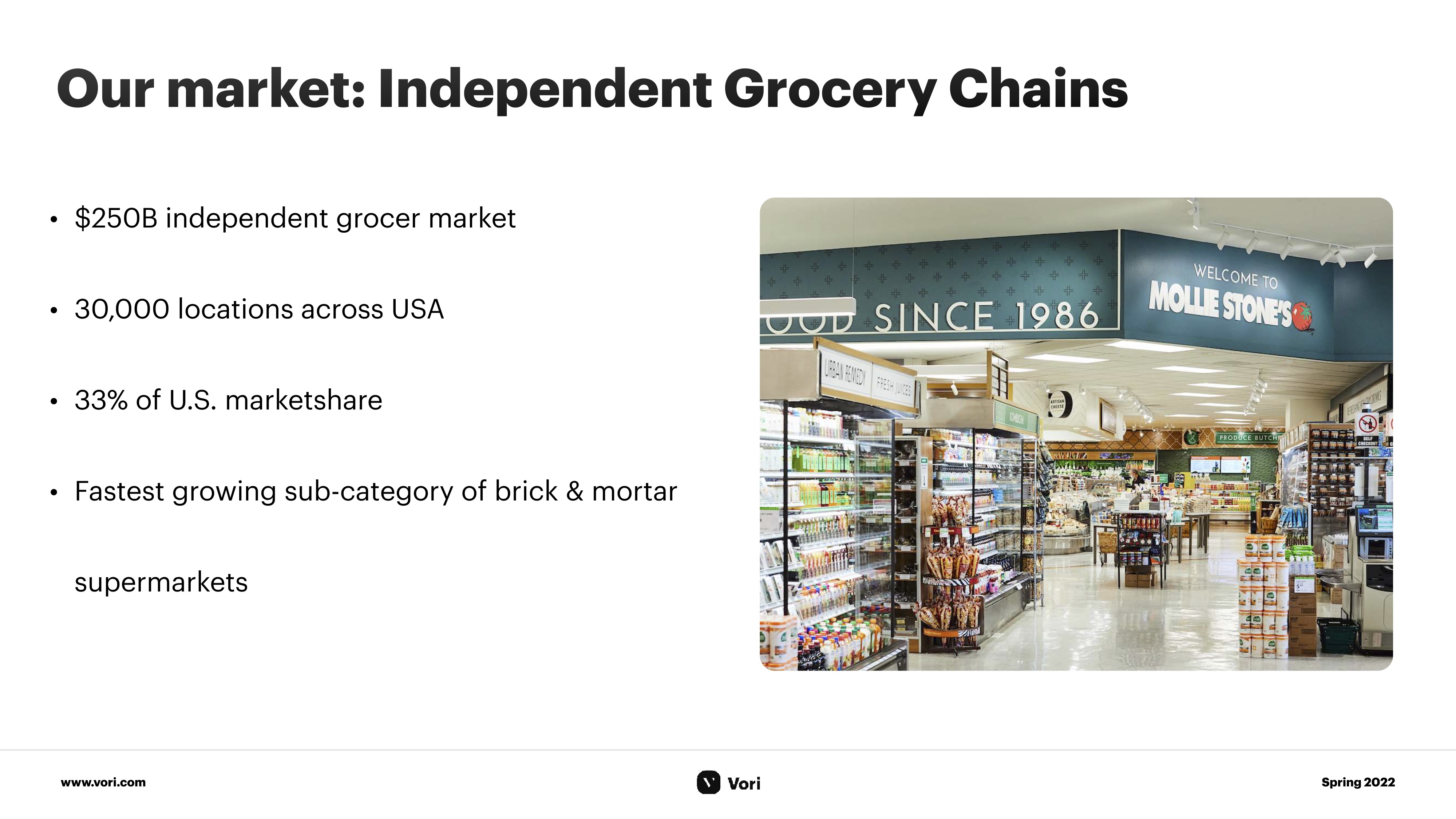

- “Our market: Independent Grocery Chains” — market slide

- “Grocery stores still run on pencil and paper” — problem slide

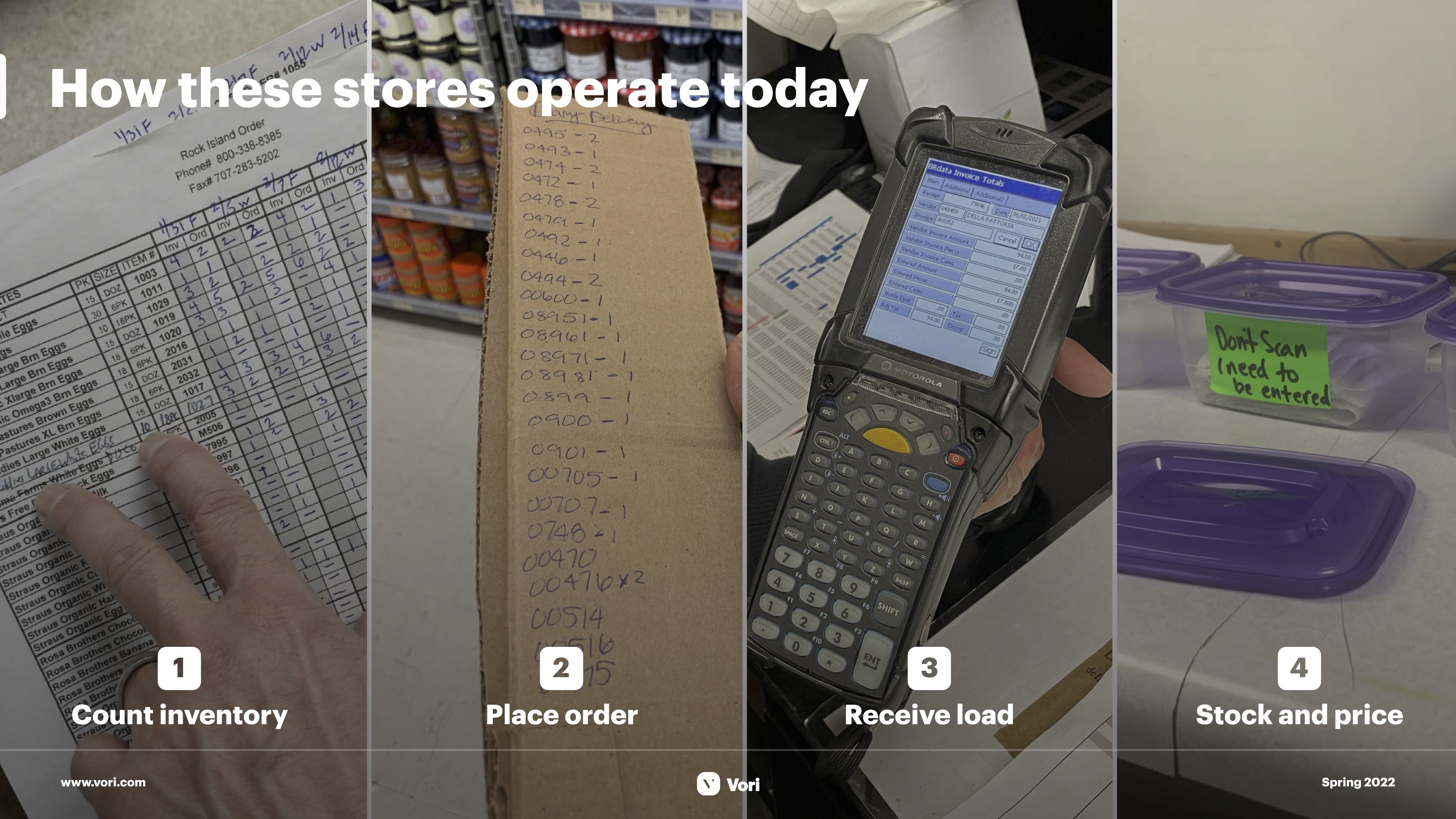

- “How these stores operate today” — problem slide

- “Suddenly, COVID changed everything in grocery” — “Why now” slide

- “Meet Vori, the all-in-one grocery back office” — solution slide

- “What retailers are saying” — market validation slide

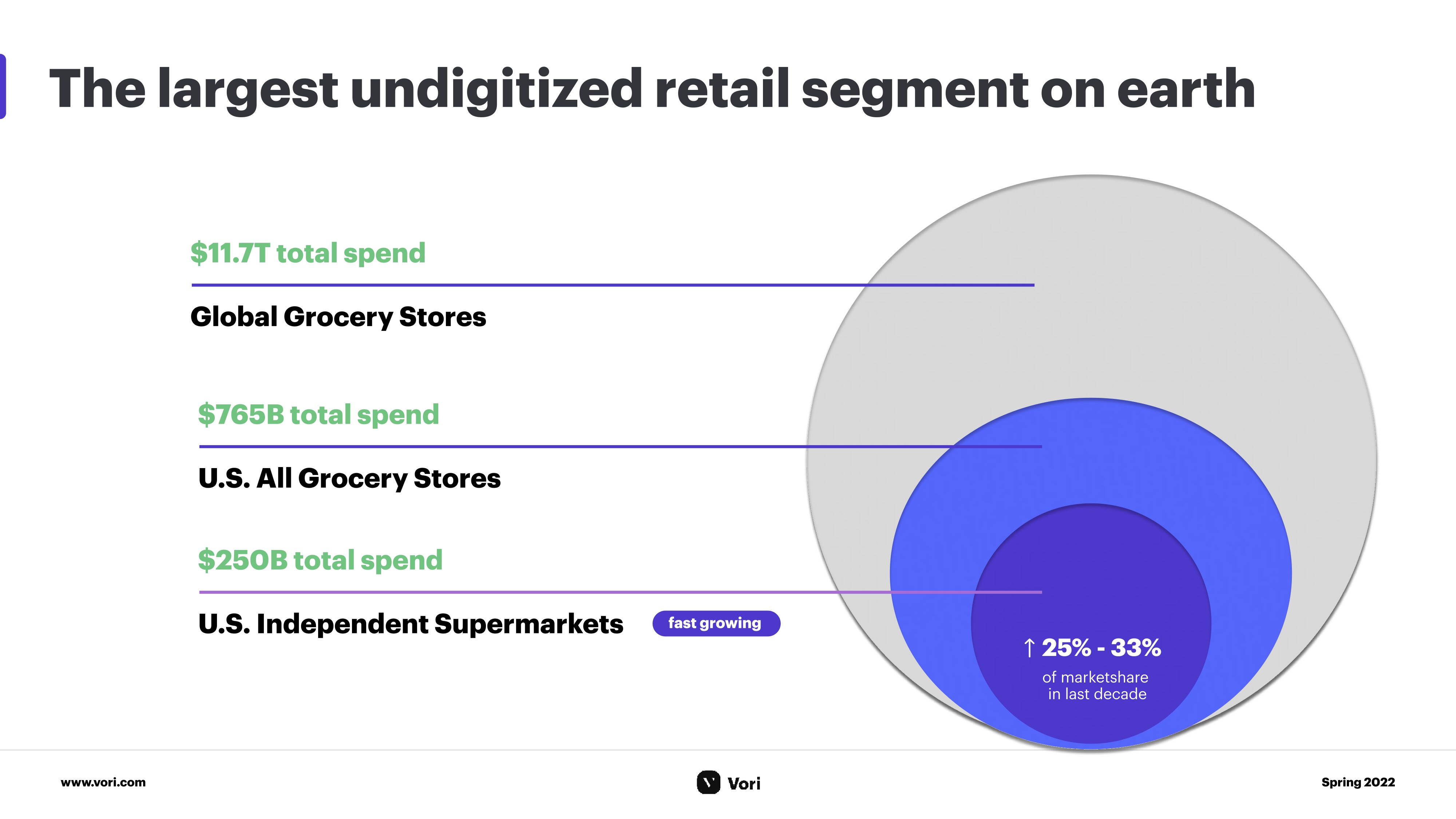

- “The largest undigitized retail segment on earth” — market size/TAM/SAM/SOM slide

- “Competing against legacy systems” — competition slide (redacted)

- “Our team was born for this” — team slide

Three things to love

When I recently talked to the DocSend team about what the most important slides are in a deck, they shared that the summary slide is starting to be more and more important. At the time, I was curious about finding a good example, and lo and behold — Vori comes along with a great one:

A tight mission

I love a good summary slide. A lot of people put it on the cover slide, but Vori takes a different approach — the first two slides set the stage for what the company is doing. The cover slide is at the top of this post and just reads “The OS for Grocery” with a few keywords, designed as tags (“order management,” “inventory management” and “analytics”). The second slide further rounds out the level-setting for what the company does: “Vori is a vertical SaaS solution for local and regional supermarket chains.”

In only a handful of words and a photo, the company makes it very easy for investors to get a high-level overview and some decent context for what they’re about to look at. That has several benefits: If investors are scared by groceries, inventory management, SaaS or regionally focused businesses, they can walk away after seeing just two slides.

The only thing I would have added to one of these two slides is a hint at the progress and size of the round. Something like “We have X customers and are raising a Series A” or even just the words “Series A” help give an indication of the order of magnitude.

Clear market size

One of the most important things you have to show VC investors is whether the company is “venture scale.” In other words, is it possible for an investor to make a half-decent return on investment? (“Half-decent” in this context is a lot more than you might think. Angel investors have very different expectations than VCs do). One of the big drivers for that is how big the market is.

Pitching a wrong-sized company to a VC shows that you don’t understand how the asset class works. Vori elegantly sidesteps that problem by getting straight to the meat of the question: Slide 4 is an interstitial (and a really sweet one at that; check it out in the full slide deck below), but Slide 5 goes bold:

I wouldn’t at all be surprised if the first question a VC asks themselves would be “Well, cool, but how many independent stores are there?” or, “How big is this market?” or, “If there is a market, is it collapsing under the weight of supermarket chain roll-ups, or is it growing?” Vori does an exceptional job at painting a picture of a market that is robust, thriving, growing and worth addressing. Now, I’d need to perform due diligence on that. (The first Google result seems to confirm that indies have a third of the market share and are worth around $250 billion but seems to suggest there are only 21,000 locations, so I’d want to dig into the data source and the discrepancies here).

Nonetheless, the size and penetration of independent supermarkets are more significant than I thought, which would indicate that perhaps this is a market paying closer attention to, after all.

This slide makes it easy for the investor to grok what the size of the market is, as well as how they can think about the size and growth of the market you are about to enter.

The alternative is god-awful

Vori does a great job at showing off — in a delightfully visual way — what the problem is. It does so across slides 6 and 7, but the latter is particularly powerful. In a world where software, automation and analytics are eating everything, it’s somewhat astonishing to see how manual the process is. That both illustrates why this problem is worth solving and inspires some curiosity around what inefficiencies live here.

I don’t know exactly how Vori does the voice-over for this slide, but if it were me, I’d explain the additional costs, the missed opportunities and the problems that are inherent in relying on old systems. This goes a long way toward explaining the value proposition. Vori doesn’t connect the dots on this slide, but I imagine the company has metrics here that can connect the use of its product to a significant increase in productivity, profitability and a reduction of mistakes. It’s a short path from there to concluding that the product pays for itself in saved time.

This slide showcases how to think empathetically with your customers and use the value prop to really ram home the point that your product is a crucial part of your customers’ lives.

In the rest of this teardown, we’ll take a look at three things Vori could have improved or done differently, along with its full pitch deck!

Three things that could be improved

The deck, overall, is very good, but it has some baffling things missing from it.

Where are your numbers and projections?

When raising a Series A, you’re raising growth capital; that means you probably have a significant number of customers. These customers, and your product, have a bunch of metrics, and not showing them off in a growth pitch deck is not great.

There’s nothing about the business model, nothing about customer performance and no indication of the types of metrics that Vori thinks are important for measuring its own business. That seems like a weird oversight at best, or incompetence at worst; investors are numbers people and using numbers to tell your story is a great way to show that you know how your business operates from within.

As a startup, what you can learn here is that it’s powerful to show off that you understand the levers and financial dynamics in your business. Use that knowledge to tell your story, and you’ll end up with a much more coherent and believable case for why the investors should back you. Get that operating plan together and add it to your pitch deck!

Whatcha gonna do with the $10 million‽

Related to the above, but distinct: If you’re raising $10 million, I’d want to know more about what milestones you are tying to that fundraise. Put simply, if I give you $10 million, what you will do with the money? The resulting milestones, goals and target metrics should paint a picture of what your business looks like in 12 to 24 months, but also give a clear indication that you know what you need to do to raise your next round of funding.

A good “ask” slide includes not only a solid set of achievable goals, but it also illustrates that you know what you need to do to grow further. It might say things like “launch in five new states,” and “onboard 200 new customers,” and “increase annual recurring revenue to $9 million” or, perhaps, “hire a strategic partnerships person to further accelerate our sales channels.” Good, measurable goals are a cornerstone of convincing investors that you have a deep understanding of your business, your customers and your market.

The SOM fallacy

When you’re trying to drill down on the total addressable market, the total serviceable market and the total obtainable market (often referred to as TAM/SAM/SOM), be very careful that you’re telling the right story. In this case, the company toes the line:

In this slide, Vori talks about “the largest undigitized retail segment,” which is likely correct, but the $785 billion of total spending in the U.S. isn’t the market size; this is the size of all spending by consumers in grocery stores. Statista has some interesting numbers there.

The problem is, Vori isn’t launching a grocery store, but a tool for grocery stores. Even if Vori’s business does as well as it can, and it gets 100% market share across every single independent supermarket in the world, that doesn’t mean that the company will have $250 billion of turnover — it means that the industry it serves turns over that amount of money.

Nowhere in its slide deck does the company address what it thinks is the upper edge of the amount of turnover in its industry. That could be done bottom-up (how much money are indie supermarkets spending on stock-keeping and analytics software, how much could that market grow and what percentage of those stores could you have as your customers?) or top-down (how many supermarkets there are, multiplied by the price of your services per supermarket — that’s your total market size).

I understand why Vori chose to use these numbers, but they are essentially meaningless at best, clueless at medium-good and deceptive at worst. As a startup, you want to make sure that you paint a rosy, aggressive picture of growth, for sure, but don’t fall for the temptation to use the largest numbers you can find. If you are a car dealership, your total serviceable market isn’t the value of the cars you sell (that’s the SOM for the car manufacturer). Your SOM is the total value of the sales commissions, service plans, aftermarket goods and services, and everything else you can actually make money on. Don’t confuse the two!

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!

Comment