India’s central bank has enforced several measures to cool down high growth in consumer credit in a move that will impact consumer spending and many startups in the South Asian market, industry executives said.

The Reserve Bank of India raised risk weights on unsecured personal loans, credit card, consumer durable loans by banks and non-banking financial companies (NBFCs) by 25% points to 125%. The new measures exclude mortgages, loans for vehicle purchases and education as well as debt backed by gold, RBI said.

A similar measure has also been announced for banks. It has raised risk weights for credit card receivables for banks and NBFCs to 150% and 125% from 125% and 100%, respectively.

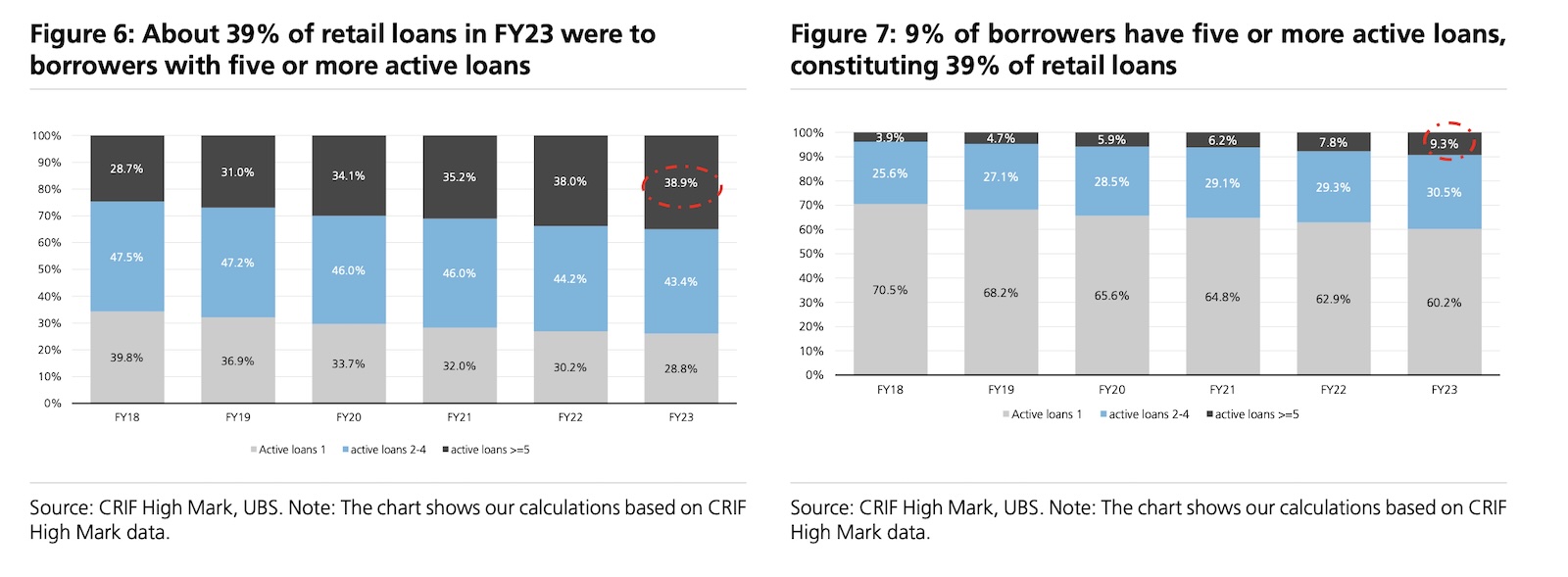

The decision comes in the wake of data indicating that the growth rate of unsecured loans is nearly double that of total credit expansion. The measures indicate that RBI is “becoming increasingly wary with the growth of these loans,” Goldman Sachs analysts said Friday.

Image and data: UBS, accessed via S&P Global Market Intelligence

The tightening by lending partners will impact many startups, most of whom rely on NBFCs to extend loans to consumers. A fintech founder, who spoke on the condition of anonymity to avoid any repercussions, said the move will reduce the growth “by a bit” and also increase the cost of capital at which startups borrow money.

“For Paytm’s lending partners, higher funding costs and increased capital requirements will affect product profitability in BNPL/PL. They may respond by tightening credit standards and/or moderating growth from elevated levels right now,” Jefferies analysts wrote in a report.

The measures suggest that RBI is concerned with heady growth in unsecured loans, and increased NBFCs reliance on bank funding, analysts said.

“We believe the implementation of these measures will, at least theoretically, reduce the structural ROEs in consumer lending, particularly for NBFCs on higher cost of funds from the banking system as well as tighter competitive intensity, as we had earlier highlighted that higher competition would mean lower unit economics, slower growth and / or asset quality challenges,” Goldman Sachs analysts said.

Many lenders, including Bajaj Finance, IDFC First and SBI that have traditionally had the highest share of unsecured personal loans as a percentage of their own books are expected to be among the most impacted.

“Over the last few years, bank funding to NBFCs in India’s finance sector has been on the rise, and it now constitutes >50% of NBFC’s borrowings. On the other hand, the proportion of borrowings from mutual funds/insurance companies has been on the decline. Per prior RBI commentary, this has prompted their action that, in turn, would make borrowing from banks more expensive for NBFCs. Moreover, we believe this would likely also increase competition in alternate sources of borrowings driving up the overall cost of funds,” Goldman Sachs analysts added.