Welcome to my weekly fintech-focused column. I’ll be publishing this every Sunday, so in between posts, be sure to listen to the Equity podcast and hear Alex Wilhelm, Natasha Mascarenhas and me riff on all things startups! And if you want to have this hit your inbox directly once it officially turns into a newsletter on May 1, sign up here.

Last week, TechCrunch’s Kyle Wiggers gave us a glimpse into Plaid co-founder’s William Hockey’s latest venture: the platform for what he believes is the first bank of its kind — a “financial infrastructure” bank. To rephrase, Hockey has founded a bank called Column.

“[Column is] a nationally chartered bank but have built every facet of the technology from scratch,” Hockey told TechCrunch in an email interview. “We are both the bank and the technology provider.”

When Hockey decided to move on from Plaid, he said in a June 2019 tweet that the move was in part to make room for more “great leaders.” And maybe Hockey was also itching to start something new because for some people, one success only fuels the desire to create another.

I also wrote last week about how in mid-2020 — after raising nearly $180 million in debt and equity — short-term rental startup Lyric Hospitality shuttered most of its locations in what was widely viewed as another pandemic casualty.

But the San Francisco company — which was out to help folks who struggled to decide between staying in a hotel or an Airbnb — wasn’t ready to go down without a fight. It has spun out the software side of its business, including a pricing tool for accommodation that it had built, and that spinout — Wheelhouse — raised $16 million in funding led by NEA, I reported last week.

At first glance, these two companies have little in common.

But dig a little deeper, and you can see — they actually do. Both stories represent a reinvention of sorts and both those pivots make me almost irrationally happy. In Hockey’s case, he was moving on from a very successful company that he’d founded — Plaid, which was almost bought by Visa but then wasn’t in a turn of events that was probably one of the best things to ever happen to the startup. That’s because in the time it took for Visa to announce its plans to buy Plaid and for the deal to fall apart, fintech exploded, and so as of last August, Plaid was worth over $13 billion — more than double the $5.3 billion Visa was going to pay for it.

In the case of Wheelhouse, its predecessor company’s core team, led by co-founder Andrew Kitchell, didn’t give up in the face of a plunge in business. And neither did many of its investors. They salvaged the software side of their business and made its own standalone company — Wheelhouse, which Kitchell describes as a “fintech platform for the $500 billion-plus flex rental space” that includes pricing and financing. In other words, its software is aimed at helping short-term and mid-length stay providers manage their properties and make more money off of them.

So why do these stories make me irrationally happy? In life, are we not constantly reinventing ourselves in the same way these founders have taken learnings from their good, and bad, experiences to move on? I don’t know about you, but I don’t even feel like the same person in many ways that I was five, 10, 15 or 20 years ago. Over the years, I’ve done a lot of things I’m proud of — and some things I’d like to forget. But all the while, I grew wiser and the person I am today represents my learnings from all those experiences.

We are forced both in life and in business to adapt — sometimes to unexpected things like global pandemics, and at other times, to things we know will happen but never really prepare for — like the death of a family member. We also adapt to success — with confidence and the desire to pay it forward (I hope) and do more great things.

Sorry to get all philosophical in what is meant to be a fintech-focused column. But what can I say? It’s been a week and I’m in a philosophical kind of mood. Don’t worry, it doesn’t happen often!

In other fintech news

Speaking of Plaid, the company introduced Plaid Income to over 40 customers in beta last year with the aim of helping streamline the process of income and employment verification, “making it entirely digital and within a few seconds.” Last week, the company rolled out Plaid Income more broadly to everyone, with new features. With the new product, Plaid says it “aims to simplify the income and employment verification process for lenders, and in turn, consumers.”

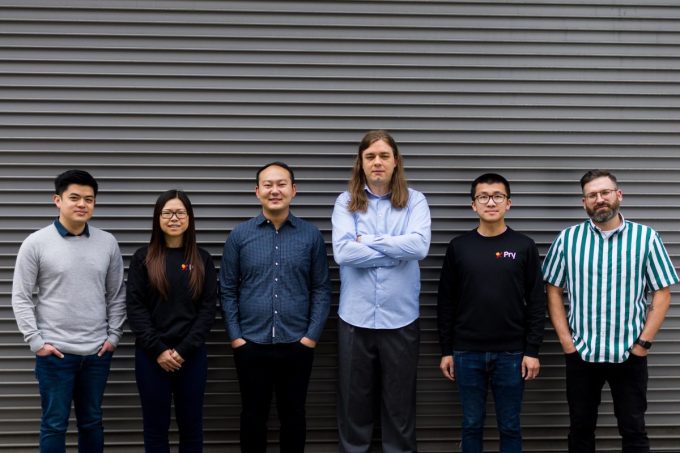

Aaannnd, speaking of multibillion-dollar companies, I exclusively covered spend management startup Brex’s second major acquisition last week. The company picked up a 10-person financial planning software startup, Pry Financials, for $90 million. The move was a testament to both Brex’s intent on moving more into being a software provider (and thus diversifying how it generates revenue) and its ongoing commitment to its original target customer: startups.

Since 2019, Pry has raised $4.2 million. Its software is aimed at helping seed to Series B companies do things like create models, budgets and “track critical financial metrics.” Co-founder and CEO Andy Su told me that when Brex CEO and co-founder Henrique Dubugras first approached him, he never expected it would result in an acquisition.

In Su’s own words:

He told me that he really loves what Pry is doing and thinks it could do really well within Brex. And I thought he was just being nice, you know? And just being encouraging to another fellow founder. But it turns out, he really meant it.

Gotta love it.

On a less positive note — once again, Better.com was in the news as the company (sadly) followed through on the scoop I had from the week before: laying off more people. Unlike in its two previous rounds of layoffs over the past five months, the online mortgage lender didn’t say how many people it let go — but it’s believed, according to multiple sources, to be anywhere from 1,200 to 1,500. If true, that would mean the company has effectively cut its headcount in half since December 1, 2021. It seems not enough folks took advantage of its voluntary resignation plan.

Meanwhile, remember that leaked video of a post-layoffs meeting the incredible Zack Whittaker and I reported on a few weeks back? Well, that video is now available for all to view on YouTube. And it’s not pretty.

On a more consumer-y note, PayPal and Venmo are increasing their instant transfer fees for both consumers and merchants in the United States in the coming weeks, PayPal announced on April 21. Instant transfers allow customers to transfer their money instantly to a bank account or debit card for a fee.

For personal accounts on PayPal and consumer and business profiles on Venmo, users will pay 1.75% of the transfer amount, with a minimum fee of $0.25 and a maximum fee of $25. Prior to this change, the instant transfer pricing for personal accounts on PayPal and consumer and business profiles on Venmo was 1.5% of the transfer amount, with a minimum fee of $0.25 and a maximum fee of $15. TC’s Aisha Malik gives us the scoop here.

On April 21, Marqeta announced its new RiskControl product suite aimed at helping card issuers combat payment card fraud. The company says that global card payments are increasing annually, with more than 450 billion card payments processed in 2020 alone. So it’s only logical that fraud is up as well.

“When we talk to our customers, the threat of payment fraud comes up consistently as one of their biggest business concerns. We’re seeing fraud increases worldwide weigh heavily on card issuers and processors, intensifying the need to offer highly effective risk and fraud management solutions that are tailored to individual cardholder experiences,” said Randy Kern, chief technology officer of Marqeta, in a statement.

Spend management startup Airbase, which targets mid-market companies, is hosting its first annual conference: Off the Ledger LIVE!, on April 26. The virtual one-day event is free to attend and will feature five CPE-eligible sessions featuring folks such as former Oracle CFO Jeff Epstein; Doximity CFO Anna Bryson; Jenny Bloom, former CFO at Zapier and Mailchimp; and Menlo Ventures Partner Matt Murphy, among others. Session topics will include fundraising, data, automation and remote teams.

“Finance teams are typically asked to do more with less. As companies scale, they are definitely the team that doesn’t grow linearly,” said Airbase Founder and CEO Thejo Kote. Learn more here.

A couple of weeks back, Tage covered some startling allegations against Olugbenga Agboola, CEO of African fintech Flutterwave. The executive was initially quiet but on April 19, he addressed those allegations for the first time in an email to employees. In this piece for TechCrunch, Tage breaks down what Agboola had to say in response, and perhaps even more importantly, what he didn’t have to say.

Flutterwave CEO addresses alleged misconduct claims in email to employees

Publicly-traded WEX, which has a market cap of $7.57 billion and provides payment processing for the fleet industry, is launching a new effort called Flume, a digital wallet which the company claims could help “upwards of 30 million small businesses that are excluded from the digital payments market.” WEX says Flume is the first outgrowth of WEX Ventures, the company’s in-house R&D — or incubator — dedicated to creating new products.

According to WEX: “Unlike most payment platforms focused on digitally enabled companies, Flume aims to help close the digital divide for overlooked trade-oriented businesses initially with less than $15 million in annual revenue.”

We’ve been talking for a while about how hot LatAm is. Last week, Ingrid gave us another example of that when she reported that Netherlands-based PayU, a fintech business controlled by Prosus with operations in 50+ countries, announced a double-deal to expand its presence in the region. The company acquired Ding, a mobile payments platform; and it led a $46 million investment into Treinta, a financial “superapp” aimed at small businesses. Both are based in Colombia. Y Combinator alum Treinta, which launched only 18 months ago, has 4 million customers. PayU has been described as the PayPal of emerging markets. More here.

Fundings

The digital transformation of banking and payments services is a red-hot trend that’s shown no signs of slowing down. Banking-as-a-service (BaaS) products like Synapse, Unit and Bond have helped fuel the shift by allowing companies to quickly spin up new financial services using APIs.

NovoPayment is a global BaaS company based in Miami that has largely been focused on offering its API platform to customers in the Latin American market. It has developed a full-stack, multicurrency solution with three main categories — data banking, payment infrastructure and card solutions, its founder and CEO Anabel Perez told TechCrunch.

Founded in 2007 by Perez and Oscar Garcia Mendoza, who now serves as chairman of NovoPayment’s board, NovoPayment had been bootstrapped since inception until it raised its Series A round earlier this year, TC’s Anita Ramaswamy reported last week. It previously raised a seed round of undisclosed size from its own founders, but the $19 million Series A marks its first institutional fundraise, according to Perez, who worked as a banker in Venezuela for two decades prior to launching NovoPayment.

Moving on to Europe. Despite the fact that immigrants to a new country can often be cash rich, they have no credit history in their new country. Plus, a consumer cannot take their credit file from one country to another. Furthermore, credit bureaus are rarely coordinated or joined up across countries. The upshot of this is that those that can get credit find themselves paying a disproportionately higher cost of borrowing. And immigrants have to start again every time they move to another country.

Companies like CapOne, Vanquis and NewDay have been promising to focus on this, but the problem remains a thorny one to solve. Credit fintech startups like Yonder, (raised £25.9 million), Keebo (raised $6.9 million) and Tymit ($21.5 million) are attempting to address this.

Adding to this roster is fintech startup Pillar, which has now raised a pre-seed round of £13 million ($16.9 million) led by Global Founders Capital and Backed VC, reported TC’s Mike Butcher last week. The company claims it will be able to provide immigrants with access to credit products when moving to a new country.

Founded by Revolut alumni Ashutosh Bhatt and CTO Adam Lewis, Pillar has an Open Banking-led data and analytics engine that will be launched in Q3 of this year. Last week we also covered Welcome Technologies and its recent raise for its immigrant-focused offering.

Can we just talk about how nearly $17 million for a pre-seed round is just crazy considering that just a few short years ago, we were reporting on $17 million Series As (and possibly even Bs)! But now, we don’t even blink an eye.

That’s it for this edition. This week marks the last time I will publish my Fintech Roundup before it graduates to an official newsletter. Eeek! I’m so excited. Thanks for joining me on this ride!! Have a wonderful weekend.

Comment