Dharmesh Thakker

More posts from Dharmesh Thakker

More than half a decade ago, my Battery Ventures partner Neeraj Agrawal penned a widely read post offering advice for enterprise-software companies hoping to reach $100 million in annual recurring revenue.

His playbook, dubbed “T2D3” — for “triple, triple, double, double, double,” referring to the stages at which a software company’s revenue should multiply — helped many high-growth startups index their growth. It also highlighted the broader explosion in industry value creation stemming from the transition of on-premise software to the cloud.

Fast forward to today, and many of T2D3’s insights are still relevant. But now it’s time to update T2D3 to account for some of the tectonic changes shaping a broader universe of B2B tech — and pushing companies to grow at rates we’ve never seen before.

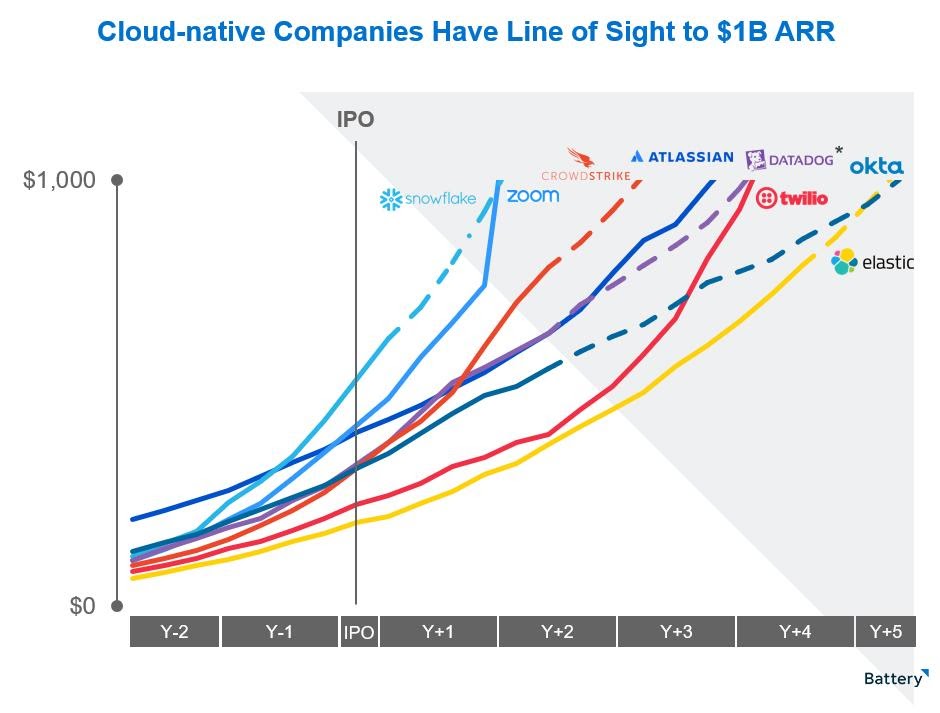

I call this new paradigm “billion-dollar B2B.” It refers to the forces shaping a new class of cloud-first, enterprise-tech behemoths with the potential to reach $1 billion in ARR — and achieve market capitalizations in excess of $50 billion or even $100 billion.

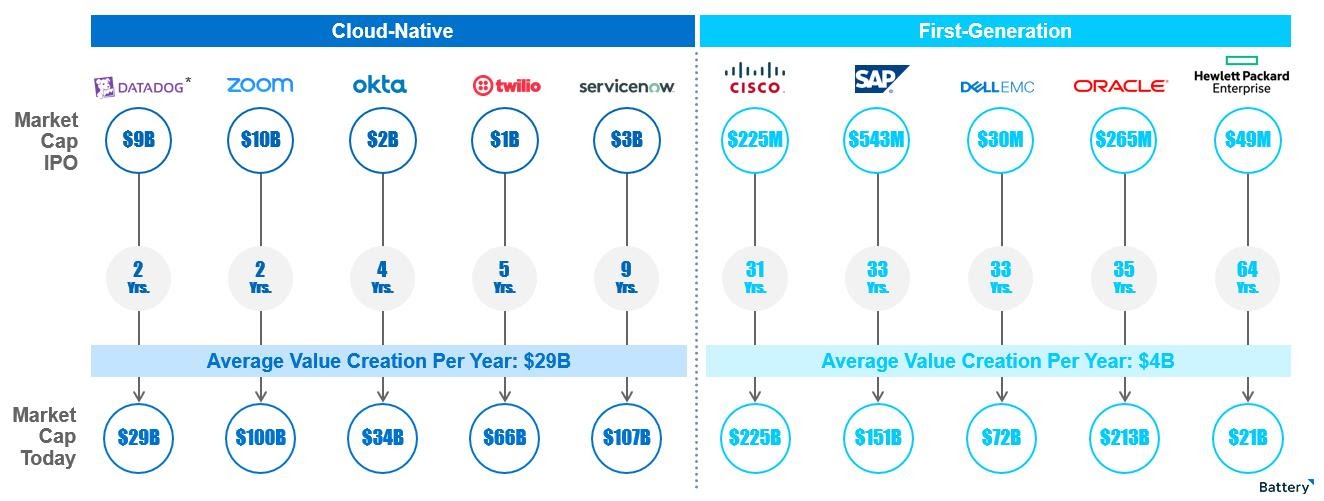

In the past several years, we’ve seen a pioneering group of B2B standouts — Twilio, Shopify, Atlassian, Okta, Coupa*, MongoDB and Zscaler, for example — approach or exceed the $1 billion revenue mark and see their market capitalizations surge 10 times or more from their IPOs to the present day (as of March 31), according to CapIQ data.

More recently, iconic companies like data giant Snowflake and video-conferencing mainstay Zoom came out of the IPO gate at even higher valuations. Zoom, with 2020 revenue of just under $883 million, is now worth close to $100 billion, per CapIQ data.

In the wings are other B2B super-unicorns like Databricks* and UiPath, which have each raised private financing rounds at valuations of more than $20 billion, per public reports, which is unprecedented in the software industry.

Compare this to the growth trajectories of old-tech names like Hewlett-Packard, Dell, Compaq and others; they took 30 or 50 years to achieve the same market capitalization.

So you’re probably wondering, is the hype real? I think billion-dollar B2B is a tech-industry paradigm with real staying power — despite recent market volatility — owing to trends like “bottoms-up” software sales models that de-emphasize traditional salespeople; the viral adoption of B2B products through active and engaged user communities; and the distribution of these B2B products to customers in easy, consumer-like ways.

What’s more, the pandemic has accelerated the push inside many large enterprises and organizations to digitize many core functions and processes and move them to the cloud, which has further boosted sales at many of these B2B giants.

Here, I’d like to offer more background on these trends and then some concrete tips for entrepreneurs building innovative, cloud-first businesses aiming to reach that $1 billion revenue mark.

Why now?

One of the biggest factors driving billion-dollar B2Bs is a simple but important shift in how organizations buy enterprise technology today.

In the old days, a high-ranking CIO or CTO essentially mandated what technologies all employees could use. CIOs cut deals to buy these products on the golf course or over steak dinners with highly compensated salespeople (no Impossible Burgers then!). Decisions were based on specific product features and functionality, often before users actually had a chance to trial the product themselves.

Fast-forward a decade or so, and the process is completely different. Now, end-user preferences — from users much lower down inside organizations — drive much of corporate technology purchasing. Atlassian, with its core Jira and Confluence products, pioneered this model a decade ago and famously got to $100 million in revenue without a real sales team. Last fiscal year, its revenue was $1.6 billion.

Now, other companies from Zoom to Twilio to Okta (last fiscal year revenue of $2.65 billion, $1.76 billion and $835 million, respectively) are doing the same thing, relying on factors like time to delight, ease of deployment and intuitive design to win customers. Eventually, the products’ use inside organizations grows, and CIOs and CTOs are forced to take notice.

Drive predictable B2B revenue growth with insights from big data and CDPs

All this has radically expanded the addressable market for B2B technology, from perhaps 20,000 executive buyers at big organizations to a more decentralized group of 56 million-plus software developers, per GitHub’s State of the Octoverse. Millions of small and medium-sized business owners with smartphones are buying this technology now, too — a trend my partner Neeraj and colleague Brandon Gleklen also discussed in their SaaS-focused “Software 2021” report released earlier this year.

Billion-dollar B2B company Shopify (2020 revenue: $2.9 billion), for example, which is working to power the back ends of 68 million global small-business websites, per its investor presentation, has benefited from this trend.

Software is also penetrating “blue-collar industries” like restaurants and home contracting, expanding the market even more. Still-private companies like Procore (2020 revenue: $400 million), ServiceTitan* and Toast — three companies that collectively have raised nearly $2 billion in funding, according to Crunchbase — are just a few examples.

Starting the $1 billion journey

So how can you leverage these trends to build your own company achieving $1 billion in revenue? Here are five tips.

Show me the usage: Focus on your community before you worry about big sales. As referenced above, your product should drive early engagement — not a salesperson. And that means cultivating a large, happy community of users who can sing your praises and speed the viral adoption of your product within their organization. Once organic usage surges, their organization may be ready to commit to a large subscription contract.

There are many examples of billion-dollar B2B companies patiently running this playbook and then seeing a big payoff. Atlassian, of course, is one. Another is MongoDB (fiscal 2021 revenue: $590 million), which leveraged the success of its popular, free open-source product and then used a team of inside sales reps to help get customers up and running with their first paid applications. Zoom doesn’t sell an open-source product, but its growth started out with a vibrant community of enthusiastic users using a free service — which only accelerated when most knowledge workers started working from home last year. When users got used to Zoom’s intuitive interface and ease of use, they started paying for the product when they needed to make longer calls and leverage more features.

Know when to bring in the big sales guns. Plenty of billion-dollar B2B companies have shown deftness in targeting the right time to activate an enterprise sales force to bring in bigger deals. Snowflake (fiscal 2021 revenue: $592 million) is a good example. The data giant started off with a low-touch, bottoms-up sales model that was extremely successful and helped value the company at around $3.5 billion by late 2019. Then, the company made the bold move of installing a new leader, Frank Slootman, the ex-CEO of ServiceNow (2020 revenue: $4.5 billion), to amp up enterprise sales and get the company to an IPO. Since Slootman joined, the company has more than doubled its revenue run rate, while also increasing sales-and-marketing spend. Snowflake now boasts more than 77 customers paying more than $1 million each, up from 31 in the pre-Slootman days.

Snowflake has also prospered by simplifying its pricing to focus on consumable units and then billing customers based on consumption. Snowflake, as well as Twilio and MongoDB, have been able to secure larger billings upfront because customers feel comfortable they will be billed only for services consumed. This also allows them to align with the underlying billing models of the large cloud-computing providers, like AWS and Google Cloud, further simplifying payments and generating goodwill.

File/storage service Dropbox, with fiscal 2020 revenue of $1.9 billion, went through a similar evolution. The company notes in its regulatory filings that 90% of its revenue comes from self-serve channels, but “once prospects are identified, [our] sales team works to broaden the adoption of [our] platform into wider-scale deployments.” As of December 31, Dropbox counted 15 million paid users, including 500,000 teams paying for Dropbox Business accounts.

Start with one product, but know when to diversify. At first, you’re probably just selling one product with a very defined use case. This is the right thing to do. But once you start establishing leadership in one product category, expanding into adjacent areas with new products can make sense. Defining this roadmap early on is important, but timing when to execute on the roadmap is critical.

Security firm Crowdstrike (fiscal 2021 revenue: $874 million), for example, started off focusing entirely on endpoint security, a market in which it succeeded — but one where it also faced several competitors. Now, Crowdstrike offers a broader platform that also includes cloud security, threat intelligence and log management, among other products.

Atlassian, which originally focused on project management and collaboration software, has expanded into areas like online chat, project-task organization and incident management. Similarly, Datadog* — which was founded in 2010 with a narrow focus on cloud-native infrastructure monitoring — has now diversified into application-performance monitoring and log management. Datadog’s 2020 revenue was just over $603.5 million.

Go inorganic: You can smartly grow through M&A. Once your company reaches a certain scale, organic growth may not be enough. You’ll need to look outside your organization toward acquisitions that can quickly add missing product functionality without compromising the focus of your existing teams. (Atlassian actually diversified its product offerings in large part through acquisitions.) These acquisitions can come in the form of both large and transformative M&A as well as small and incremental tuck-in acquisitions.

Recently, we’ve seen several billion-dollar B2B companies pursue innovative — and big-dollar — M&A strategies to grow. Salesforce has been one of the most acquisitive companies in tech over the last 10 years, scooping up companies like ExactTarget (paying $2.5 billion in June 2013); Tableau ($15.7 billion in June 2019); and, most recently, Slack ($27.7 billion in December 2020), among others. Communications/messaging API company Twilio, meanwhile, has also shown a penchant for inorganic growth through its acquisition of customer-data platform Segment ($3.2 billion in October 2020) and other companies.

Focus on talent and company culture. Hiring the right talent, and managing talent and culture, has always been one of the biggest potential stumbling blocks for rapidly growing B2B companies. Now, with traditional office culture upended by COVID-19, these issues are more complex than ever. Will you go 100% remote? Hire C-level talent from anywhere and not mandate that your executive team work in one geography? If you opt to go hybrid, how do you handle pricey existing office leases in places like San Francisco or New York?

Another key consideration is diversity and inclusion, which studies show has a direct impact on a company’s financial performance. Some billion-dollar B2B companies are making great progress here. A few years ago, Salesforce CEO Marc Benioff famously announced he was spending about $3 million to equalize pay between men and women at his company; by 2019, Salesforce had spent more than $10 million to increase female employees’ pay. Billion-dollar B2B Okta recently put out a comprehensive State of Inclusion report outlining its efforts around “DIB,” or diversity, inclusion and belonging.

“We are committed to DIB because it’s not just the right thing to do, but because it’s the smart thing to do for our employees, our community and our business,” CEO Todd McKinnon wrote at the beginning of the report. Transparent efforts like these are a great way to make sure your company is accessing the best possible talent.

There are more billion-dollar B2B standouts to come

By focusing on the practitioner, not the buyer, and adopting many of the self-service, viral selling tactics used by consumer-tech companies, I believe forward-thinking B2B tech companies can now continue logging 50% or more annual revenue growth rates even at a $300 million to $500 million scale. Furthermore, by leveraging the user and developer community to augment R&D and by rethinking enterprise sales, they can streamline customer-acquisition costs, reduce other expenses and drive profitability and more than 30% operating margins at scale.

The next-generation B2B-tech companies that succeed can achieve valuations of $50 billion or even $100 billion, and I predict we’ll see more of these this year and into 2022.

*Denotes a past or present Battery portfolio company. For a full list of all Battery investments, please click here. No assumptions should be made that any investments identified above were or will be profitable. It should not be assumed that recommendations in the future will be profitable or equal the performance of the companies identified above.

Content obtained from third-party sources, although believed to be reliable, has not been independently verified as to its accuracy or completeness and cannot be guaranteed. Battery Ventures has no obligation to update, modify or amend the content of this post nor notify its readers in the event that any information, opinion, projection, forecast or estimate included, changes or subsequently becomes inaccurate.

B2B marketplaces will be the next billion-dollar e-commerce startups

Comment