Years after it got initial approval, Jacobi Asset Management’s bitcoin spot exchange traded fund (ETF) went live this week, making the product the first of its kind in Europe.

This is only the latest sign that Europe is making steady progress toward integrating crypto assets inside traditional financial instruments. Meanwhile, the U.S. Securities and Exchange Commission (SEC) is dragging its feet by delaying deadlines for similar applications.

That’s not to say there hasn’t been any progress stateside. According to Eric Balchunas, senior ETF analyst at Bloomberg, bitcoin futures ETFs do exist in the United States, but they account for only about $1 billion in total assets under management (AUM), “So that does exist, but the spot is the holy grail. The spot bitcoin ETF [will be] major,” he said on TechCrunch’s Chain Reaction podcast.

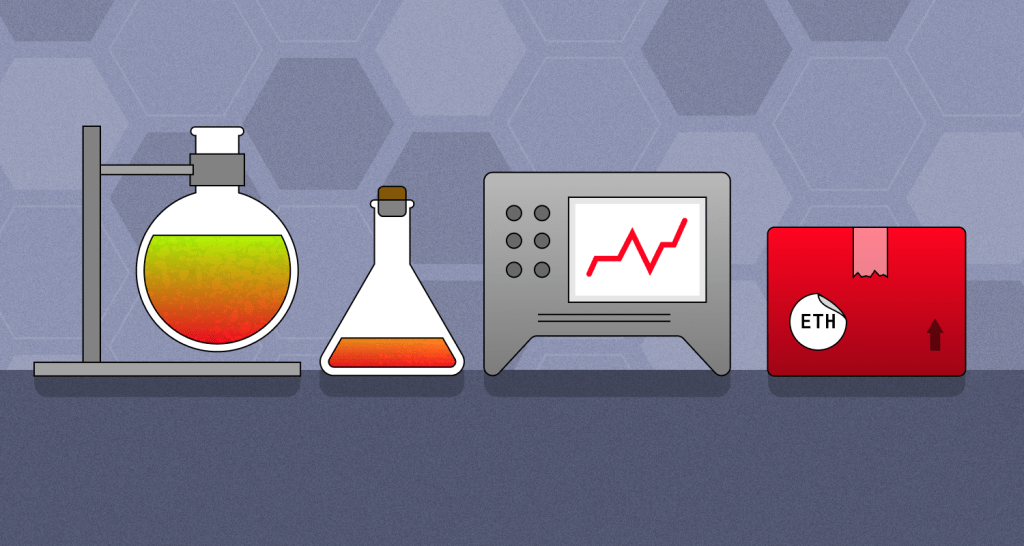

The difference between a spot ETF and a futures ETF is that the former actually purchases and holds the underlying assets. It’s a more popular approach than futures-related ETFs. According to Balchunas, spot gold ETFs, for example, have consumed the majority of gold ETF activity, and bitcoin could be traded similarly if it gets regulatory approval.

Lots of money is potentially up for grabs. “The stakes are high” for the various entities working to bring a spot bitcoin ETF to the American market, Balchunas argued. About 10 firms are competing to get the first bitcoin spot ETF approved in the U.S., and BlackRock, which has more than $9 trillion in assets under management, filed for its own offering in June.

BlackRock also partnered with Coinbase in 2022 to provide its institutional clients with access to cryptocurrency, and later launched its own spot bitcoin private trust for U.S. institutional clients.

“The question is, will [the SEC] approve [a bitcoin spot ETF], when will they approve it and how many they’ll approve at once,” Balchunas said. Right now, he and other Bloomberg analysts estimate 65% odds that the regulator will approve one or more by the end of the year. The odds are even higher for next year.

“Everything is evolving towards that,” Balchunas added. “I don’t think it’s going to completely change the face of crypto. I think what it does is offer a portal for a big lump of money that largely would not probably deal with bitcoin, [but] might now. That would be the $30 trillion that financial advisors manage in America.”

In other words, a bitcoin spot ETF could be considered the bridge that connects trillions of dollars to crypto. “Not everyone is going to cross that bridge, but you’ll certainly find some traffic there,” Balchunas said.

Why do we care about bitcoin ETFs?

Why does an ETF matter, since we have so many exchanges around the world that allow consumers and institutions alike to purchase crypto-related assets and securities? Well, because ETFs could allow folks in the traditional financial world to buy into the crypto market using their existing investing services — companies like Fidelity and Vanguard that may hold retirement assets, for example.

Bringing bitcoin to the TradFi market in a manner that is already well-understood from an operational, trading, and fee perspective, could unlock lots of demand for the cryptocurrency in the near-term. Such interest could lead to the ETF in question buying more total bitcoin to meet demand, shifting crypto’s supply equation. More demand with flat supply would send the price up, in other words.

There is nuance to the BlackRock ETF that warrants attention. While Balchunas did hazard a guess where fees for such a product could land, that’s not the fee schedule we are interested in. Instead, the cost for trading the ETF will be de minimis, around 1 basis point.

If that is the case, and the ETF does a good job tracking the price of bitcoin and it is incredibly liquid, then there’s no reason for regular folks to buy bitcoin how they do today. As we all know, you have to jump through a slew of hoops before you can actually say you own any crypto.

A bitcoin spot ETF could also lead to lower demand for the trading services on crypto exchanges, which have so far powered leading players in the ecosystem. Until recently, Coinbase made its daily bread on trading fees, not interest derived from its holdings, after all.

“For an advisor, [a bitcoin spot ETF] wouldn’t be the main part of their portfolio; it would be like hot sauce — a small [bit] on top,” Balchunas said. “In ETF land, advisors would pay more for hot sauce,” especially for something that could go up in a hurry, he added.

Still, with Coinbase partnering with BlackRock for its potential ETF, the crypto exchange could find itself eating on both sides of the plate. It can continue earning fees for its crypto asset trading services while milking TradFi demand by helping power BlackRock’s ETF effort.

It will be simpler to get your parents up and running with an ETF than onboarding them to, say, Binance. So perhaps the two demographics — crypto novice and crypto native — are sufficiently differentiated that they won’t eat into one another.

There has been a lot of noise over the years about institutional money pouring into crypto and the impact of such an influx of cash. Institutional money managers are coming to crypto, potentially unlocking more small-ball demand for crypto, and crypto’s current gatekeepers will find their roles changing, then, to more facilitating this shift than actually helping generate demand as the category begins opening up to the wider world.

More to come when we get a damn bitcoin spot ETF approval over the line and can truly vet market demand for the product. That’d finally let us more clearly see its impact on other parts of the larger web3 world.

This story was inspired by an episode of TechCrunch’s podcast Chain Reaction. Subscribe to Chain Reaction on Apple Podcasts, Spotify or your favorite pod platform to hear more stories and tips from the entrepreneurs building today’s most innovative companies.

Connect with us:

- On X, formerly known as Twitter, here.

- Via email: chainreaction@prod22.techcrunch.com