Nikhil Sachdev

Crypto has had a rough couple of months as much of the downward macro pressure hammering software and fintech hit the broader crypto market. Valuations have collapsed, revenue growth (for many companies) is starting to slow down, and institutional and retail capital is pulling back at scale.

One area of crypto that is weathering the storm quite well is “infrastructure,” the companies and protocols that help enable the core functionality of other crypto companies. Despite seeing negative price pressure mostly in line with the broader market, these infrastructure companies have continued to generate sustainable revenue by servicing emerging but clear, durable use cases.

Furthermore, many of these companies are expanding horizontally and vertically to become true enterprise-grade infrastructure, a process expedited by the large influx of capital and Web 2.0 talent in the space.

Looking forward, we expect companies and protocols focused on building critical infrastructure to continue to emerge and scale, driving attractive investment opportunities.

The six-layer cake model

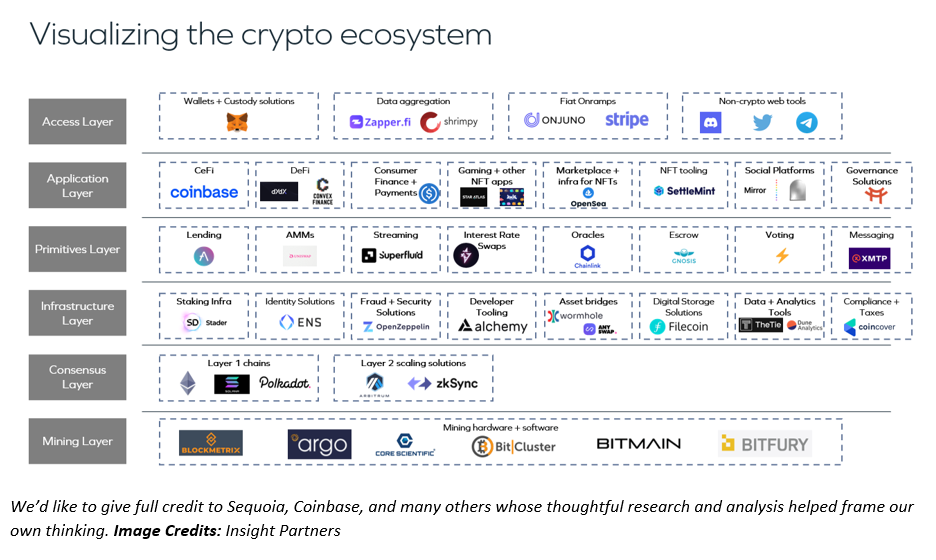

To better understand the crypto landscape, we unpacked the sector into its core technology layers, which culminated in a six-layer crypto stack, ranging from the basic settlement/mining layer, all the way through the consumer-facing decentralized application and access layer.

Between these two extremes is a spectrum of infrastructure providers, hybrid infrastructure application tools known as primitives, and composable applications that codify, enable and make accessible the various use cases across the crypto ecosystem.

Imagine a consumer wants to swap ETH for another Ethereum-based token on a decentralized exchange — a swapping protocol that lets two assets trade against each other without an order book.

The initial set of steps for this consumer exists in the access layer. This layer is focused on giving individuals or institutions the tools to interact with decentralized applications and networks. For our swapping example, the access layer will equip consumers with a few key essentials:

- A self-custodied wallet: An intuitive UI/UX abstraction of a set of public and private keys that lets you interact with a distributed ledger or programmable chain. The consumer will likely choose to use a wallet provider.

- A fiat on-ramp: For onboarding money into the crypto ecosystem.

- Data aggregation tools: To see the quantity and value of holdings.

The next layer is the application layer itself — in this case, the user facing the front end the consumer interacts with. This would be the website and application portal of the exchange through which the user sets the parameters of the trade (e.g., what price per token is acceptable) and requests to execute the trade.

At this point we cross the threshold into enablement layers, which allow this simple swap to occur. The first layer in this group is the primitive layer. Primitives are core features or functions, usually a “basic” protocol with a standard set of contracts, that enable entire micro-ecosystems to live on top of it.

In our example, the relevant primitive is foundational to DeFi. It’s a set of connected swapping smart contracts that facilitate this swap. This set of contracts enables two important tasks to occur in our example:

- Sets a dynamic exchange rate between the tokens, driven by the relative demand for each.

- Incentivizes the market to lend large quantities of both tokens to the exchange (called providing liquidity) to ensure the exchange has sufficient reserves of each to facilitate a smooth exchange.

Before jumping to how this swap is actually executed by the Ethereum blockchain, it is necessary to discuss the infrastructure layer that let this decentralized exchange write, audit, deploy and monitor the efficacy and security of its swapping contracts. Before the user ever interacted with the swap contract, the decentralized exchange likely utilized the following:

- Developer tools, usually bundled together by a provider like Alchemy.

- A developer environment for writing and testing the efficacy of the contract.

- A node provider to read and write data and transactions to and from the blockchain.

- Security solutions to audit and test the contract for vulnerabilities, probably from a top-tier provider.

- Compliance and tax tools to enable compliant execution and recording of the swap for reporting.

This brings us to our final two steps: the consensus and mining layers. Once the smart contract executes, it will send a request to record a transfer of assets between wallets, which will be ordered and verified into a block by the mining layer. The user gets their token in exchange for their ETH, and the Ethereum blockchain records this transfer in a permanent, public manner.

The key takeaway here is that behind a relatively simple transfer of assets, you have a multilayered set of interlocking dependencies supporting an ecosystem of decentralized applications, users and capital.

Key investment themes from our Web 2.0 investing

It’s said that the best investment opportunity in a gold rush is the business selling the picks and shovels. However, we’d argue that there’s an even better place to invest in said proverbial gold rush to maximize risk-reward: owning the land and property all of those pickaxe shops and miners need to rent.

For every miner, shop and other institution in town, real estate is the foundational, basic “infrastructure” — you can’t build a thriving pickaxe business without somewhere to physically house it.

This is similar to how we have approached investments in the software sector. While there are plenty of amazing software companies, the best investments are often enablement or infrastructure providers that SaaS companies depend on. We believe these types of investments have three distinct advantages:

- Infrastructure is often mission critical, not a “nice to have.” The best infra companies have strong core value propositions that drive durable growth.

- Infrastructure is a way to play growth in a particular end market without being exposed to single-company or idea risk.

- Infrastructure companies often have exceptional financial profiles characterized by high growth, high retention, diverse revenue sources and high margins.

Applying the infrastructure thesis to crypto

We believe crypto will produce many successful infrastructure-like companies that embody the mission criticality, de-risked growth and strong financial profiles of their Web 2.0 peers. Below is an outline of where in crypto we think these attractive investments are most likely to emerge and why we’re excited to invest in these subsectors:

Infrastructure layer

These are the tooling and core enablement providers that will power the next generation of protocols. We see huge value in tools that abstract and enable fundamental activities in crypto.

- Security: About $14 billion has been stolen in code and non-code-based attacks on crypto protocols. Companies building security tooling will continue to be foundational pieces of infrastructure.

- Developer tools: Tooling that expedites and simplifies the production of dApps will be crucial to meaningfully spur the growth and quality of the ecosystem.

- Data and analytics: The quantity of data in crypto can be overwhelming. Tooling that structures and derives insights from this mass of data is increasingly a core service that every party in the ecosystem requires.

Consensus layer

This encompasses the activity, growth and adoption of entire ecosystems.

- Scaling solutions (L2): We expect the transactions occurring in crypto to continue to grow exponentially. To serve this demand, new and innovative scaling solutions for existing chains, or more advanced next-generation chains will become necessary. This is especially true as more complicated activities begin to happen natively on-chain (e.g., massively multiplayer video games).

Business models, stakeholder incentives and modes of interaction may radically change in moments of disruption, but the first-principle elements of a durable, sustainable value proposition rarely do.

By thinking critically about what has fueled successful investments in the past, and applying those processes to this new paradigm, we can accelerate a new generation of incredible protocols and companies.

Disclaimer: The opinions above are solely the authors’ and do not necessarily represent the views and opinions of Insight Partners.

Comment