Ryan Falvey

More posts from Ryan Falvey

According to industry reports, venture capital deal-making has notably rebounded since dropping off briefly in March as shelter-in-place orders gripped much of the country.

As seed-stage fintech investors, this has certainly been our experience: “Hot” deals are getting funded faster than ever, and we increasingly see the large multistage global funds competing for the earliest access to companies. However, in our experience and anecdotal conversations with other early-stage investors, that excitement has not been translating to the Series A stage.

We’ve increasingly wondered if the Series A market in fintech is really as hot as it seems. As pre-seed and seed-stage investors, we know that the health of the Series A market is of critical importance.

In early October 2020, the Financial Venture Studio put together a brief survey of the Series A market in fintech and shared it with more than 100 investors with whom we work closely. Despite the high-level numbers indicating a healthy market, our research indicates a market that remains in flux, with significant ramifications for early-stage founders.

Why Series A is so interesting

Although the seed and pre-seed fintech market continues to attract substantial entrepreneurial and investor interest, it is also in some ways one of the easiest parts of the market to fund. The check size is smaller, the velocity of new deals is highest, and while the potential returns are also the highest, this is also the part of the market where information is most scarce. Perhaps counterintuitively, the fact that there is so little information on a business — aside from a plan, a team and maybe some early anecdotal evidence to support the vision — actually makes it easier to “pull the trigger” on deals where those data points align. There just often isn’t a lot more to dig into.

Similarly, by the time a company is raising Series B capital, they typically have some objective evidence that the idea is working. Companies are typically generating revenue, small teams have grown and become more sophisticated in how they operate, and importantly, the governance functions of a company have (hopefully) begun to take shape. The simple existence of a board member with invested capital at stake means that some of the more existential risks of the earliest stage have been mitigated.

In contrast, one of the big milestones for any startup has been to raise a Series A from an institutional investor. Besides an infusion of capital (which is often 2-3x the aggregate capital a company may have raised since its inception), this “stamp of approval” lends credibility to a small company that is trying to hire talent, sell to customers, and, in most cases, raise substantial subsequent capital.

Thus, it’s critical that Series A investors remain active; if not, many of these upstart companies may fail due to a lack of investment, even if they are able to demonstrate early market traction. The Series A funding market is one of — if not the most — critical funding stage in the innovation economy because it acts as a bridge between scrappy early innovation and commercialization at scale.

It stands to reason, then, that dollar amounts invested may not be the best barometer of the ecosystem’s health. What really matters is the volume of companies being funded and the variety of product approaches being pursued.

The post-COVID Series A

Once the initial shock of the pandemic wore off, the VC community had to get back to business, which admittedly is harder to do for funds that write $10 million+ checks and like getting to know founders in person. Still, Series A investors made it a point to let entrepreneurs know they were, and continue to be, “open for business.”

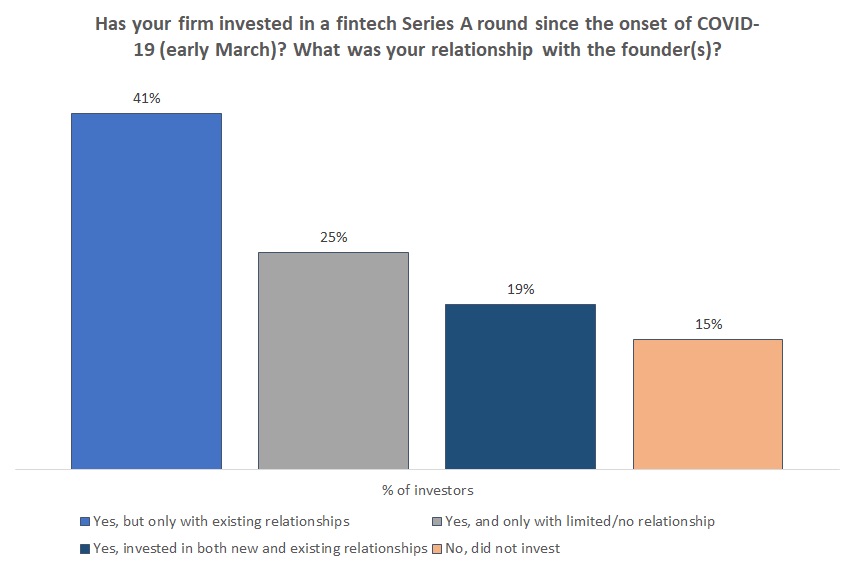

As investors have gotten more comfortable with the new normal, they have been more open to a virtual diligence process. Of the firms we surveyed, only 15% stated they have not completed a Series A investment during COVID-19 work restrictions. Of the firms who completed a Series A investment during COVID-19 (~85%), about half invested in a company whose founder(s) they had a limited or no relationship with prior to the onset of shelter-in-place orders.

The shift to a virtual environment means that process is more important than ever. Numerous investors have cited their renewed focus on following a structured approach to sourcing and diligence. The interpersonal aspect remains important to close a deal, but customer references, referrals from trusted seed-stage investors and a heightened scrutiny of metrics are all at the forefront of investors’ evaluations.

A “K-shaped” market

[This market] looks to be having a K-shaped recovery, just like the economy in general. Hot companies are super hot, most others still struggle to raise.

—Neil Devani, Necessary Ventures

Overall, nearly half of the investors we surveyed described the market as “hot,” “crazy,” or some variation thereof. There seems to be tremendous pressure to go after what are perceived as the “best deals,” which can lead to a short duration between a seed series and Series A (or even Series A to Series B). This intense environment seems to be creating a flight to quality and stark bifurcation for seed-stage fintech companies.

Rather than lose out on a potential industry winner, some investors are comfortable with pushing up valuations or taking on higher risk (product development, go-to-market, etc.) for the same price. We refer to this strategy as “picking the winners”: putting more money into the highest conviction bets and hoping to create a business that can quickly raise subsequent growth capital.

Company creation is way up. There’s a real sense of winners and losers, with winners getting big valuation bumps.

—Partner at a large early-stage VC fund

At the other end of the market, companies that can’t quickly raise at a premium might need to “weather the storm” and focus on managing their cash burn and solidifying the core product and metrics.

This insight is reflected in the data: Approximately 60% of the funds we surveyed stated that they had a seed-stage portfolio company complete a bridge or extension round in lieu of a Series A. This mirrors anecdotal evidence we have seen of investors telling portfolio companies to reduce burn, reduce churn and focus on the Series A later on.

The market seems more bifurcated than ever. If you clear the hurdle of being able to raise (which is a higher bar), the rounds are insanely competitive and get bid up.

—Jason Demant, Foundation Capital

Even with extreme interest in some deals, a number of top-tier multibillion dollar global funds reported doing no new Series A fintech deals since the onset of the pandemic. At the extreme end of this was one large multistage fund, which mentioned that since March, it had closely reviewed but passed on 15 fintech companies that went on to complete their Series A rounds elsewhere. Several of these larger investors have also reported being more comfortable partnering with a select group of companies at even earlier stages, in hopes of preserving their seat at the table when the time comes to raise a Series A.

It is worth noting that some of the lopsided nature of the market may be due to the fact that several highly influential investors (including Andreessen Horowitz’s Angela Strange, Bain Capital’s Matt Harris, and QED’s Frank Rotman) have similar and well-known theses on the innovation opportunities in the market. In particular, startups that are building fintech infrastructure and BaaS (banking as a service) solutions have enjoyed high levels of investor demand while other categories, such as student lending and direct-to-consumer solutions, seem to have been impacted by regulatory factors or perceived oversaturation. Obviously, newer companies that create a sense of urgency will get a short-term, albeit large, premium, but it remains to be seen how this plays out in the longer term.

What founders are saying

To complement the investors’ perspective, we also spoke with several founders who raised a Series A round over the past six months. Their experience seems consistent with what investors said about the market. One founder received a pre-empted term sheet, ran a very quick process and selected the investor that the team felt most comfortable with. Importantly, the founder felt that they did not have to sacrifice valuation and still achieved alignment with a high-quality investor.

Several other founders ran a broader process, with one even speaking to over 70 investors. Interestingly, founders reported that over 50% of the investors they spoke with were “new” relationships, meaning that they met the investor for the first time in a virtual format. It seems that fintech investors have a slight advantage over generalist funds, as they are quickly able to understand the business and move faster toward a close. One founder suggested that fintech founders looking to raise a Series A should spend two weeks pitching fintech investors, and then go out to the broader market of generalist investors.

All founders were quick to note that pitching remotely is uniquely challenging; one founder recommended practicing with mock virtual pitches and to have multiple people on the screen to get into the habit of pitching without seeing body language.

While we are encouraged by the level of activity in early-stage fintech and the progress the industry has made to return to “normal,” the market for Series A fintech remains challenging for the vast majority of startup founders. Our recommendation to our own founders is to continue to be conservative in managing cash and dedicate more time and attention to building relationships with prospective Series A investors well in advance of a planned fundraise. The more that founders can engage their current investor base in helping to build these relationships, the better.

While our strategy as investors has long been focused on helping our founders navigate the complexities of the U.S. financial infrastructure, regulators, the media and investors, we too have found ourselves spending more time managing co-investor relationships than we did prior to the pandemic. We’d encourage founders to push their own investors to do the same.

The Series A survey was created by Venture Studio, Inc. in October 2020 and is the result of a landscape survey send out to 100 venture capital investors in order to gauge the environment for Series A investments, specifically in fintech.

As venture capital rebounds, what’s going on with venture debt?

Comment