The traditional role of the real estate agent has long been challenged as the internet has made it easier for people to search for, and tour, homes.

Historically, agents have received 6% commission on home sales — a practice that is increasingly being called into question. The argument against it is that oftentimes buyers have already done much of the legwork when identifying a home to purchase so the work of an agent is not what it once used to be pre-internet days.

Over the years, real estate tech companies such as Redfin have attempted to upend the model by hiring agents as salaried employees but that hasn’t always proven successful.

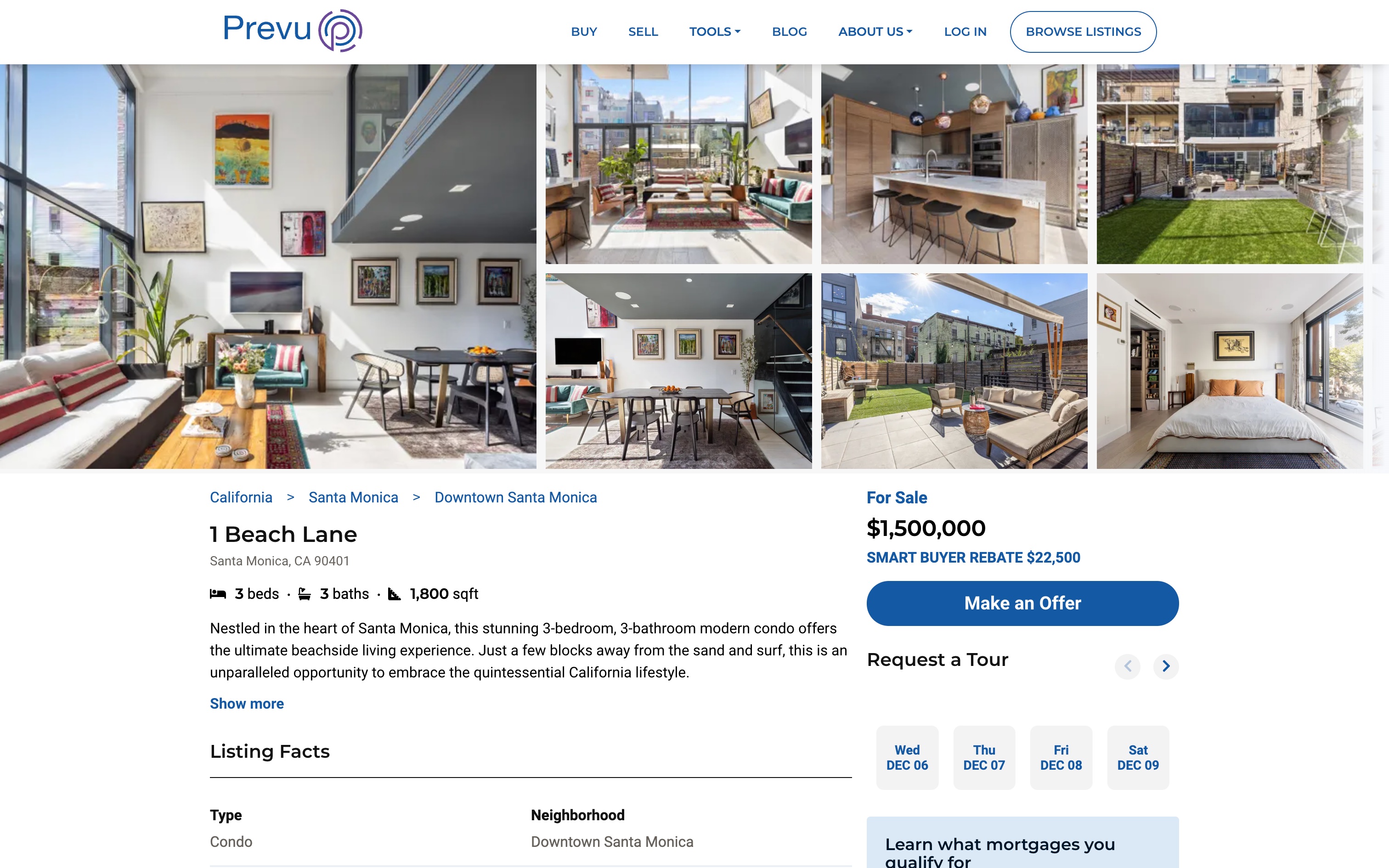

That hasn’t deterred a number of startups in the space, though. New York–based Prevu (pronounced preview) is one such startup. It hires agents as salaried employees with healthcare benefits and retirement plans, and operates under the premise that “the role of an agent is changing.”

“It’s becoming much more of an adviser in an important transaction more akin to wealth management,” said Prevu co-founder and co-CEO Thomas Kutzman. “So the agent really becomes an extension of a brand as opposed to being their own little business.”

Further differentiating Prevu’s business is its offering of a rebate to buyers if they purchase a home using its platform.

In an environment where interest rates are sky high — hovering between 7.5% and 8% — and there’s a shortage of homes available in most markets, the ability to get cash back when buying a home can be attractive.

Since launching its digital home-buying platform in June of 2017, Prevu has helped over 1,200 home buyers purchase homes totaling over $1.5 billion worth of real estate. Homes have ranged in price from $250,000 to an $8 million apartment in New York City.

Over time, the company says it has saved consumers an average of $23,000 per home purchase with its rebate program.

Prevu aims to modernize the customer experience by allowing home buyers to search for homes, schedule tours, draft offers and collaborate with a dedicated agent through its digital offering. About 50% of its customers come on to the platform ready to make a direct offer on a home, and seeking expertise with the more complex parts of the purchase process.

“People come for the rebate but stay for the user experience,” Kutzman said. “Prevu offers an Amazon-like feel with up-to-the-minute updates, such as text messages when tours are confirmed. It’s much more of what people are accustomed to in every other vertical of their life, but they haven’t been receiving it in real estate.”

Image Credits: Prevu

Today the company is announcing that it has raised $6 million in a Series A funding round that included participation from new investors Citi, Alpaca Ventures, Winklevoss Capital, RiverPark Ventures, Metropolis Ventures, Simplex Ventures and Liebenthal Ventures. They joined existing backers Alpaca VC, TYH Ventures and Blue Ivy Ventures, all of which put money in Prevu’s $2 million seed round in late 2019. Since that round, the startup has seen its annual revenue grow by nearly 10x, according to Kutzman.

Prevu’s geographic footprint has grown to 12 major metropolitan markets from its initial market of New York City at the time of that seed round, with six of these markets launching in the past six to nine months. It currently operates in New York City, Boston, Philadelphia, New Jersey, Washington, D.C., Maryland, Northern Virginia, South Florida, Southern California, San Francisco Bay Area, Seattle, Denver and Austin.

The startup currently generates revenue from commission on each real estate transaction — totaling 1% to 1.5% of transaction value, net of customer rebate.

The buyers’ agent commission varies from transaction to transaction depending on what is offered by the seller. In a scenario where the buyer’s agent commission is 3%, for example, the home buyer would receive up to 1.5% as a rebate and Prevu as a company would retain the other 1.5%. Prevu agents do earn a “small” commission on every transaction in addition to their salaries.

Buyers receive the commission rebate via check after closing.

Down the line, Prevu plans to begin offering access to more services long-term related to mortgage, title and other buyer-related services. In fact, last year, it purchased mortgage technology from the now-defunct proptech Reali, which shut down last year. Part of its new capital will go toward that, as well as to accelerate growth into new markets and expand in existing markets such as Texas and Florida. Long-term, it aims to be a nationwide brand.

Making home buying “more attainable”

So besides rebates, what is Prevu doing that’s different from its competitors?

It boils down to its proprietary technology, Kutzman believes.

“A lot of people have tried to change the cost of the service, but they don’t actually innovate on the actual technology that allows them to service the business, and ultimately they had major problems scaling,” he said. “We create a better consumer experience, but also it’s really also the back end of ‘how does that collaboration occur between the consumer and the agent?’”

That technology, too, has helped the company stay lean from a hiring standpoint. Prevu currently has 25 employees, the majority of whom are agents.

“We’ve hired as we’ve gone to new markets but we haven’t had hiring be a bottleneck like a lot of other competitors,” Kutzman said. “If you look at traditional brokerages, it’s all about hiring other agents. Our average agent does 40 deals per year, whereas a top-tier brokerage will do somewhere between five and eight deals per year. So we have a higher level of efficiency where the salary can work.”

Co-founder and co-CEO Chase Marsh says buyers are using the rebates in a variety of ways.

“With the affordability crisis, interest rates having done what they’ve done, and home prices not coming down to a large degree, people are using cash back to do things like furnish their new homes, win bidding wars, or to lower mortgage rates by buying points on their mortgage,” he said.

Jeff Meyers, a director at Citi (which wrote the largest check in the Series A round), told TechCrunch via email that he was drawn to a few things about Prevu, including its Smart Buyer commission rebate because it “makes home buying more attainable.”

Plus, he was impressed with “its buyer-focused platform,” which provides individuals with “more control and greater access to enhanced digital tools.”

Daniel Fetner, a general partner at Alpaca VC, noted that his firm was also an early investor in real estate company Compass and has watched “closely” as the residential home buying experience has changed over the years.

“We believe that Prevu’s value proposition is a no-brainer for today’s ‘smart buyer’ who wants to use Prevu as a friend in the early miles, and as an expert at the end of the transaction,” he said.

Want more fintech news in your inbox? Sign up for The Interchange here.