The SPAC craze is slowing in the wake of myriad missteps.

Companies as far afield from one another as BuzzFeed (media), Bird (e-scooter fleets), and Dave (consumer fintech), among other recent SPAC-led debuts, have shed value since their blank-check combinations. The result of the SPAC boom looks more like a series of misses with a few hits (SoFi) than a viable exit path for highly valued technology companies that remain private.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

And yet, there’s still life in the SPAC game, and one particular combination could prove to be a bellwether for future unicorn liquidity via blank-check companies.

The company in question, MariaDB, is the force behind the open source project of the same name. MariaDB the software is an “open source relational database,” as the company writes, meaning that it’s available for free. The company also has an enterprise product (subscription-based) that includes support and a hosted version of its service called SkySQL.

MariaDB is a modern open source software company with recurring revenues that is going public via a SPAC. This means that the deal will take a startup that has raised nine figures of private capital to the public markets in an expedited manner. For unicorns that are too expensive to sell themselves, but not yet mature enough for a traditional IPO, MariaDB the company is setting precedent.

This morning, we’re talking MariaDB’s recurring revenues, its forecasts, its deal and what we can glean from the transaction at this distance.

This morning, we’re talking MariaDB’s recurring revenues, its forecasts, its deal and what we can glean from the transaction at this distance.

Why? Because if the price that MariaDB has secured for itself through the deal is attractive, it could indicate that while many SPACs have struggled post-combination, there could still be a path for software companies with well-understood business models to lever blank-check companies to public-market debuts.

Given the rising unicorn backlog that the recent explosion in venture capital dealmaking has created, it’s critical to understand what exit paths are open and which are not. So let’s get into this SPAC deal, yeah?

MariaDB’s SPAC transaction

Let’s very briefly chat through the transaction details, and then get into the meat of MariaDB’s business results.

Per the company’s release, it intends to merge with Angel Pond Holdings Corporation. The transaction is a little complicated, involving a “$104 million private placement of Series D Preferred shares of MariaDB” that “closed concurrently with [the] announcement,” along with a “$43 million commitment from existing investors and $27 million from an affiliate of Angel Pond’s sponsor.”

In simpler terms, a lot of money is being pledged to the company and the deal, which the release claims “shows the commitment and conviction of Angel Pond’s sponsor in the transaction.” Normally we’d gloss over corporate boilerplate of that sort, but in this case, it actually matters. A good chunk of capital is going into MariaDB as part of this deal in a manner that appears to limit the take-backs that many SPAC deals have struggled with at close.

In total, the deal could yield as much as “$317 million of net cash proceeds,” though that number will change a little, redemptions depending.

Finally, the transaction values MariaDB with an enterprise value of $672 million and an equity value of $973.6 million, according to an investor presentation. That means that MariaDB will be valued in traditional terms at just about the unicorn mark. That means we’re seeing a unicorn software debut by SPAC. Next: results.

Business outcomes

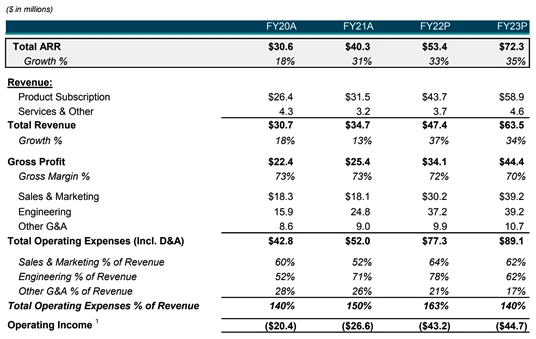

MariaDB’s results are included in the below chart excerpted from its investor presentation. Note that through its fiscal 2021, results are actuals, while the rightmost two columns are projections. Also, observe expected operating cost increases and resulting revenue growth rate acceleration:

From its fiscal 2020 to 2021, MariaDB’s revenue growth was not impressive. Decelerating from 18% year-over-year growth to 13% revenue expansion is just not good. But the company actually reduced its sales and marketing costs last year, while investing heavily in its R&D work. If you are a long-term believer in the tech that the company is building, you might be able to read that as a bullish brace of expenses to consider.

This year, MariaDB expects to nearly double its sales and marketing spend, and add greatly — again! — to its engineering costs. The result of these cost increases is an anticipated reacceleration of revenue growth to 37%. That figure moderates in fiscal 2023 projections, while ARR expansion in fact adds a few points of pace at the same time.

The bottom-line cost of the company’s anticipated spending and resulting growth acceleration are rising operating deficits, which is normal for a growing private software company but perhaps less normal for public concerns. Got all that? Good — let’s talk about what it adds up to.

Good deal or ill omen?

MariaDB is getting a pretty good price for its equity and a bundle of cash to boot. The transaction indicates that unicorns and companies near that valuation mark with mid-double-digit ARR can find a SPAC partner that will take them to the public markets far in advance of when they might be able to on their own.

That’s why the combination matters. One unicorn going public? That’s not a story that will change the unicorn exit market dynamics. A smaller, slower-growing software company commanding a unicorn price and finding capital access through a SPAC? For unicorns in the middle and lower tiers of quality in their cohort, the MariaDB deal could help them set course.

Using MariaDB’s enterprise value, the company is valued at “14.2x expected fiscal 2022 (ending September 2022) revenue of $47.4 million.” Fair enough. But if we compare the company’s ARR number from the end of its fiscal 2021 to its SPAC-deal equity value, we get a far higher 24.2x multiple. That feels rich for MariaDB’s historical revenue growth.

Therefore, if the SPAC deal performs well when it trades, it could lead more private software companies to try to follow the path that MariaDB forged. If the deal follows other SPACs downward, well, it will be even more clear that SPACs will wind up a failure when it comes to unlocking mass unicorn liquidity.

Comment