As venture capital totals grow in Latin America, the region is about to see its leading champion go public. Nubank’s IPO is coming into closer focus after the Brazilian neobank filed privately to list its shares in both the United States and its home market, later releasing a public IPO filing.

One investor in the company that caught our eye for its Latin American investments is QED. As it turns out, its first investment in the region was Nubank, a deal that is set to pay off handsomely.

Per Crunchbase data, QED put capital into Nubank’s 2014 Series A, 2015 Series B, 2016 Series D and 2018 Series E, though there may be more dollars in play that we cannot see. According to an interview, QED only invested in the company after being impressed with its CEO, David Vélez, instead of due to a larger push into Latin American fintech.

Since then, the fintech-focused fund has made more investments in the region. QED partner Lauren Morton is dedicated to the Latin American market for the investor, so we reached out to get her take on recent results from the region. Last week, The Exchange delved into fintech investment from a global investment pool powering a host of Latin American financial technology companies, including QED portfolio company Pomelo. This morning, we’re tuning in to a single voice to further our understanding.

QED has been investing in LatAm for seven years now, so the spike in valuation has been great for our back book and our legacy fund, but it has also made it more expensive and more competitive for new deals. Lauren Morton

QED recently closed $1.05 billion to invest in global fintech companies, across a $550 million early-stage fund and a $500 million growth-stage fund that, TechCrunch reported at the time, will back “fintech companies primarily in the U.S., the United Kingdom, Latin America and Southeast Asia.”

This should help add more names to a portfolio that includes several LatAm fintechs that recently raised new rounds, such as crypto exchange Bitso, SMB lender Cora, payment infra provider Hash and B2B credit card provider Tribal Credit.

Let’s talk about how the boom in valuations is proving to be both a bonus and a cost center for investors putting capital into Latin America today.

TechCrunch: On a high level, why are you and QED bullish about fintech in Latin America?

Lauren Morton: QED is incredibly bullish about the fintech opportunities in LatAm. Latin America has a large, young population that is adopting technology at some of the fastest rates in the world. The infrastructure is starting to catch up to build the foundations upon which great companies can be created. Compared to other more developed markets, the number of friction points is also staggering — from data to payment rails to access to capital — resulting in massive opportunities to disrupt traditional players.

There’s also real generational change happening across the region. It has of course been accelerated by COVID-19, but we had seen the early tailwinds of this step function to digital even prior to the pandemic. More money is coming into the region than ever before and the quality of the entrepreneurs and founding teams has never been stronger.

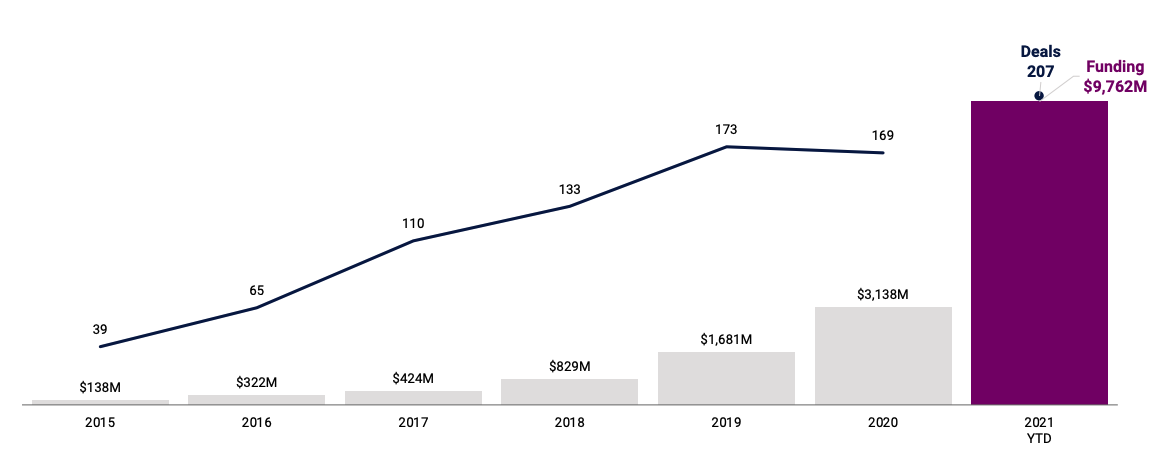

The chart below is quite impressive — does it reflect what you have been seeing in the region this year?

The growth, and the speed of this growth, is something that QED is seeing on a daily basis. While the number of deals is in line with the trend we’ve been seeing since we first invested in LatAm in Nubank in 2014, the real eye-popping number is in the sheer amount of funding coming into the ecosystem here. While global fintech funding has doubled over the past year, funding in LatAm has more than tripled, proving that LatAm, and specifically Brazil and Mexico, is one of the hottest markets for financial technology disruptors and the investors looking to back these companies.

Term sheets are being turned around in hours and not days, and QED has had to stay nimble to meet the needs of the ecosystem. We have had to flex our traditional investment process to meet teams quicker and find conviction faster than ever before. One of the most unique aspects of QED, and an advantage we have in this respect, is that we are all fintech, all the time. We go to school on trends and verticals and business models so that we are best prepared for when an investment opportunity in one of our main theses emerges.

More specifically, how competitive has deal-making been since the beginning of the year when it comes to investing in LatAm fintechs? Have valuations evolved in any direction, and was that evolution starker at some stages?

Deal-making has been frenetic, in line in many ways with what we’re seeing across the rest of the world. Valuations are higher than they have ever been and the speed at which term sheets are being issued is faster than I have ever seen. QED has been investing in LatAm for seven years now, so the spike in valuation has been great for our back book and our legacy fund, but it has also made it more expensive and more competitive for new deals.

I think it’s accurate to say that what would have been considered a Series B-sized investment when we first entered the region seven years ago is now effectively a Series A round.

With it being so competitive at the Series A and B stages, we have made a concerted effort to look even earlier. Seed and Series A has always been our sweet spot, but we are spending a significant portion of our time at the seed and pre-seed stage, not only in Brazil and Mexico, but also in countries like Argentina, Chile and Colombia.

Earlier this year, QED launched Fontes for just this purpose — to invest in early-stage companies across the region while building out the community. It’s a network-driven fund with a number of our portfolio company CEOs signed on as investors to really help them give back to the fintech ecosystem.

[Editor’s note: And as TC reported, it is a $12 million fund with an average check size of $300,000 to $500,000.]

What impact do you expect the Nubank IPO to have on other LatAm fintechs’ fundraising and exits, if any?

I think this will be the clearest indication yet that you can build a juggernaut of a company in Latin America. Anybody who has followed the Nubank story over the past few years knows how special that company is, and its IPO will just cement that opinion.

There are a number of other huge fintechs in LatAm that have, or soon will, reach escape velocity. Investors see these icons as a sign that the ecosystem is prime for investing, and entrepreneurs see this sign as a shining beacon of what is possible. It wasn’t that long ago that there were only a few international funds in LatAm — today, every VC is trying to get a piece of the pie. But even as new generalist funds come into the region, our comparative advantage of being a fintech specialist with strong existing traction in the region continues to drive positively selected inbound deal flow on a massive scale.

What are your expectations for the rest of the year in terms of dealmaking volume and pace?

I think the volume and pace we have seen so far this year will continue into 2022, but we’re also realistic enough to know that valuations can’t keep rising indefinitely. There will be a correction at some point, but make no mistake that some big, real businesses will emerge over the next few years regardless of whether money into the region slows down or not.

What are some spaces within fintech in LatAm that you are particularly bullish about for 2022 and beyond?

QED is excited about a number of LatAm fintech sectors, from payments and infrastructure to insurtech and proptech. I also think the open banking ecosystem in Brazil lends itself to innovation, and I’m excited to see how embedded financial services can transform the industry.

Comment